Last week, Europe’s parliament voted to increase emissions regulations in its member nations – a move that would see average vehicular CO2 emissions in 2030 drop by 40 percent relative to 2021 levels.

The 2021 CO2 targets are already regarded as strict, with automakers compelled to achieve a fleet average – that is, the CO2 output of all of their cars sold averaged out to a per-vehicle figure – of just 95 grams of CO2 per kilometre. To put that into perspective, a Mazda 3 with a 2.0-litre petrol engine emits an average of 134g/km of CO2 (according to the government’s Green Vehicle Guide), while a current-generation Toyota Corolla hybrid misses the 95g/km target by just 2g/km.

Light commercial vehicles are given some leeway, and are allowed to emit an average of 147g/km – still an ambitious figure for that class.

And that’s just for 2020. The proposed limit for 2030 is a mere 38g/km for passenger cars, a figure that would be impossible for most manufacturers to achieve without extensive electrification.

But why are we telling you this, when European laws have limited impact on Australian legislation?

Simple: if demand driven by the European market, which accounts for 15.6 million new cars annually in passenger cars alone, leads to a rise in the availability of more electrified models, it’s a fair assumption that this would eventually lead to greater choice of EVS, PHEVs and conventional hybrids in our market.

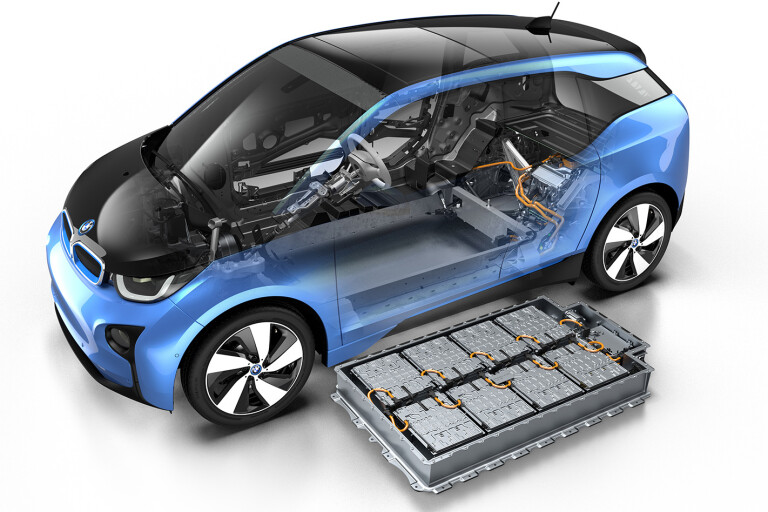

Increased demand for cars that rely on high-capacity batteries will bring economies of scale to that component – the part that makes most EVs more expensive than their combustion-engined counterparts. If production volume drives the cost of batteries down, then electric vehicles will get close to – or achieve – price parity with conventional vehicles. Even in countries that don’t tax vehicles on CO2 output or provide incentives for electric cars, like Australia.

Non-Europe-based carmakers are also planning for a strict CO2 future, with Mazda recently announcing that their entire vehicle line-up will be electrified in some way. [https://www.whichcar.com.au/car-news/mazda-reveals-plans-for-all-electric-model-rotary-powered-hybrid ]. There’s only one hitch – ensuring that the industry as a whole will have adequate supplies of the raw materials necessary to produce electric vehicle battery packs.

“Right now there is a shortfall in batteries,” said Renault CEO and chairman Carlos Ghosn to the Financial Times at the Paris Motor Show last week, “we need more capacity”.

“It’s no question that we have the capacity to assemble the cars, but there are not enough batteries, not enough motors. We are already in the situation where we cannot fulfil demand.”

Ghosn’s words carry gravity, as the Nissan-Renault-Mitsubishi alliance he helms accounts for the lion’s share of global EV sales. And as the supply/demand equation dictates, a shortage of the former and an abundance of the latter means prices will remain high until that relationship equalises.

The issue is compounded by European motorists moving away from diesel engines, previously seen as low-emission heroes but now tainted in the wake of Volkswagen Group’s ‘dieselgate’ drama. High uptake of diesel passenger cars in Europe helped bring down fleet average emissions, but with consumer appetite for them waning in favour of petrol powerplants there’s now upward pressure on CO2 output. Wide-scale electrification is the only way of achieving the proposed emissions targets.

A diesel downturn is a trend we’re seeing in Australia as well. Sales of privately-owned diesel passenger cars have slumped by 31.3 percent so far this year. Even sales of diesel SUVs – a segment where diesel has long enjoyed healthy market penetration – have dropped by 8.8 percent relative to 2017 levels. It seems even Australians are leaning toward alternatives.

There are clearly some hurdles to be overcome before the European parliament’s vision of an ultra-low-emissions transportation sector can become reality, but if all of this talk about forcing automakers to cut back on pollution has you concerned, don’t be. It should eventually mean Australians will have better access to cleaner cars that pollute less and cost peanuts to run.

Just how long that will take is the real question.

COMMENTS