This week the Coalition Government handed down its third Federal Budget, spelling out how it will spend the nation’s hard-won tax revenue for the next financial year, and the years beyond that. As always, there’s devil in the detail.

Here are the seven things you need to know about how Federal Treasurer Scott Morrison’s plans to spend his slice of your hard-earned dollars and change the way you feel behind the wheel.

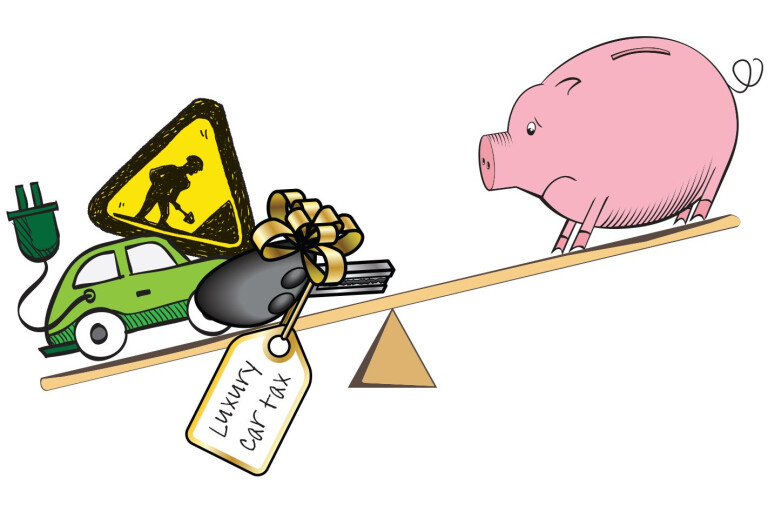

1. WE’RE GOING TO PAY A LOT MORE LUXURY CAR TAX

Car sales are booming at the moment, and part of that boom is happening in the showrooms of luxury brands including Audi, BMW, Lexus and Mercedes-Benz. The LCT was introduced to Australia in 2001 along with the Goods and Services Tax, and has been a blight on the luxury car brands’ landscape ever since.

The tax kicks in as soon as you pay more than $63,184 for a car, be it a limousine, four-wheel-drive or sports car. There’s a loophole for fuel-efficient cars that use no more than 7.0 litres per 100 kilometres of fuel, introduced after grumbles that it would slam the brakes on buyers kicking tyres in luxury car showrooms because they were willing to pay more for cutting edge fuel-efficient technology, which doesn’t kick in until the price hits $75,375.

The luxury car tax is worth $3 billion to the government over the next five years, so we’re talking big numbers with lots of zeroes after them. Surprisingly, the government has hinted that it expects its plans to change grey import laws – which will allow mum and dad buyers to bring in near-new cheap cars from the UK and Japan instead of from their local dealer – to spark a flurry of extra luxury car imports that will add an extra $30 million to its bank balance.

2. SPENDING ON ROAD SAFETY IS A MIXED BAG

It’s hard to make an accurate back-to-back comparison with last year’s Federal Budget, but it appears we’re not getting all we were promised on this front. The Roads to Recovery program, designed to help local governments patch up poor-quality roads, was supposed to be worth $3.2 billion over five years.

Do the maths on the announcement this week that the program is worth $400 million a year including an extra $50 million a year, though, and that only adds up to $2.4 billion.

On the bright side, the government has extended its $60 million a year black spot removal program, designed to improve the safety of dangerous stretches of roads with “roundabouts, crash barriers and street lights”, as well as maintenance and bridge replacement programs.

3. ROADWORKS DOLLARS SHUFFLED

Victoria was to have dug a tunnel under inner Melbourne using a $1.5 billion federal grant that matched state funding dollar-for-dollar, but the project fell through. That money has now been reallocated to other projects including the Monash Freeway, the M80 Ring Road, rural roads, and projects to “relieve congestion in urban areas”.

That’s it. Every other road-based project is stuff that has already had its day in the limelight in an earlier budget.

4. MORE FREE LESSONS FOR LEARNER DRIVERS

The Keys2drive program gives learner drivers a free lesson as well as a rev up about how vulnerable they are on the road once they have their ticket to drive. Pundits claim it has done its job of teaching vulnerable drivers how to drive safely, so the government has extended it by another year with a $4 million extension to offer the service to another 90,000 free lessons. Sign up for one here. (keys2drive.com.au)

5. THINK ABOUT BUYING A NEW CAR SOON

Why? Look at the Federal Government’s projections for passenger car import duties, and for the next few years it stays relatively flat, and even declines despite new-car sales that are expected to hover around 1.1 million units a year. But in the 2019-20 financial year, import duty revenue – it’s the bit the carmakers have to pay to bring a vehicle off a boat in Australia – suddenly jumps almost 30 percent. No explanation is given, but you can bet we won’t suddenly be selling 300,000 more new cars. Or that the carmakers will be absorbing the extra cost.

6. YOU MIGHT BE BETTER OFF CATCHING THE TRAIN

Rail was the big winner from this budget, with the government handing around high fives over the $10.7 billion Inland Rail Link, an ambitious plan to drive trains between Melbourne and Brisbane, and Brisbane and Perth. Perth is getting $490 million to build a rail link to the airport.

7. THE GOVERNMENT STILL DOESN’T LIKE HYBRID OR ELECTRIC CARS

That’s right. Despite governments the world over trying to steer new-car buyers into more fuel-efficient, greenhouse gas-reducing, smog-free technology, the Australian government has stumped up nothing.

Bear in mind, too, that even though we’re experiencing a run of very low fuel prices, the amount of tax we pay on the petrol and diesel we use is expected to increase by about $400 million for each year of the budget projection. All fuel excise, levied at the rate of almost 40 cents a litre, is just absorbed into general revenue, so there’s no way of telling where that money is spent.

Given that in 2020 the Australian government has to show the world if it is hitting its targets on reducing greenhouse emissions, you’d have thought any little effort, such as a subsidy to reduce the cost of cutting-edge fuel-efficient technology, would have helped.

COMMENTS