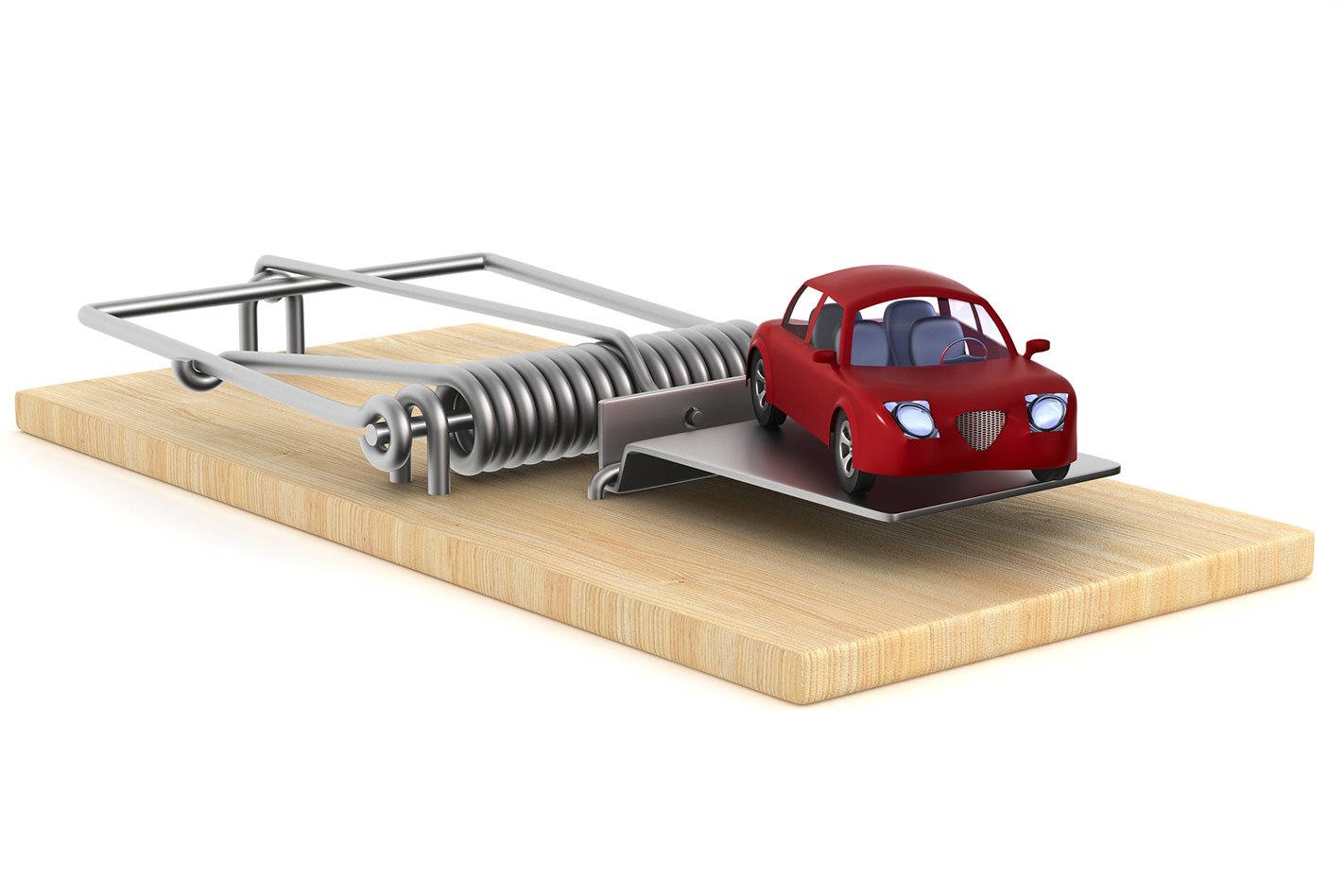

THE APPROVAL of unaffordable and overpriced car loans is endemic to the practises surrounding loans that originate from car dealerships, according to the Royal Commission into the Misconduct in the Banking, Superannuation and Financial Services Industry.

The concept of ‘flex commissions’ is at the root of the most unscrupulous practice highlighted during the inquiry. Under a flex commission arrangement, dealers can set car-loan interest rates above the lender’s base rate. The higher the interest rate accepted by the consumer, the larger the commission earned by the car dealer.

The Royal Commission shed light on the practice, which was formally banned last September by corporate regulator, the Australian Securities and Investments Commission (ASIC). Yet consumers remain exposed, with Westpac signalling its intention to continue with this commission arrangement until the ban comes into effect in November this year.

ANZ, meanwhile, has suspended its $2.5b car financing business, having sold its $8.2bn Esanda Dealer Finance portfolio back in October 2015.

An internal analysis by St George Bank in 2015 into the car loan commission structure found that “There are weaknesses in the design of remuneration structures and monitoring of sales practices for dealerships who are originating retail auto finance loans … current practises significantly increase the risk of unfair consumer outcomes where dealer behaviour may be influenced by commission plan design and the ability of a customer to negotiate.”

The Royal Commission has also heard from consumers whose ‘unaffordable’ car loans should never have been approved. Loan approvals based on unverified or falsified income details – including details swapped with those of guarantors – and with living expenses recorded as zero or not verified were shockingly common.

Car dealerships can operate in three distinct roles under the National Consumer Credit Protection Act 2009 (Cth), the most common of which, under an exemption from the credit licencing regime as a ‘supplier of goods or services’, places the obligation to ensure compliance on the Australian Credit Licence holder (the lender) rather than the car dealer.

Finance, as well as the sales of insurance, (and accessories, spare parts and servicing) contributes significantly to dealers’ overall profitability. Dealerships are likely to consider their margin on a car purchase on a whole transaction basis, and are often prepared to discount the car while making their profit elsewhere.