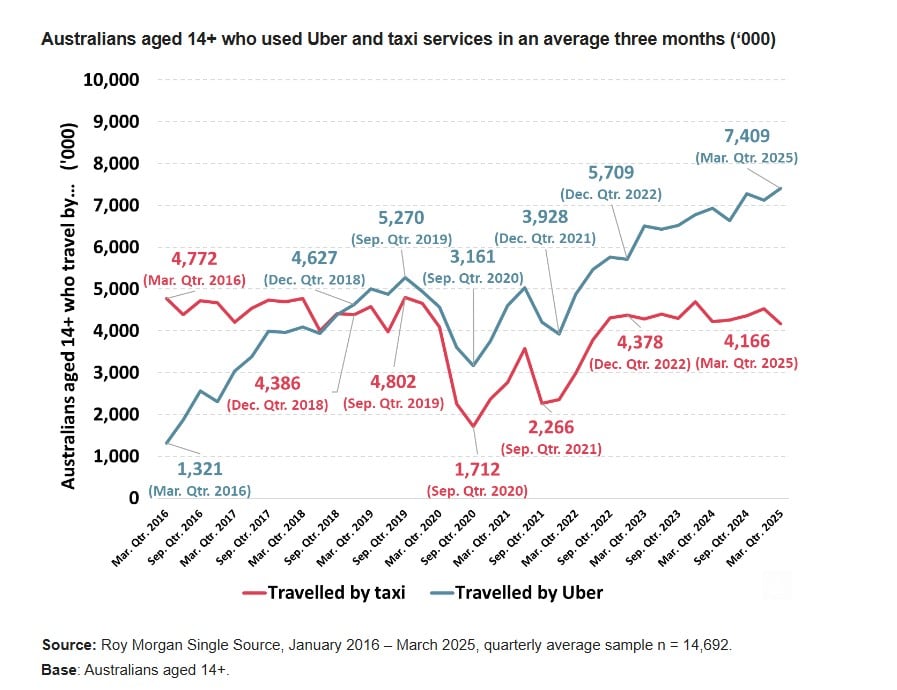

Uber has cemented its dominance over traditional taxi services in Australia, with new data from Roy Morgan revealing that more than 7.4 million Australians aged 14 and over (32.3%) used the ride-sharing service during the March Quarter of 2025. In contrast, only around 4.2 million (18.1%) opted for taxis over the same period – marking a record gap of over 3 million in favour of Uber.

The data highlights a continued upward trajectory for Uber, whose usage has surged by 1.7 million people – or nearly 30 per cent – since pandemic restrictions were lifted at the end of 2022. Meanwhile, taxi usage has experienced a modest decline, dropping by 212,000 users (4.8 per cent) over the same period.

Compared to pre-pandemic figures in September 2019, Uber’s user base has ballooned by more than 2.1 million Australians, an increase of 40.6 per cent. Taxi usage, however, has fallen by 630,000 (13.3 per cent). Uber first overtook taxis as the country’s preferred paid passenger vehicle service in 2018–19 and has steadily widened the gap ever since.

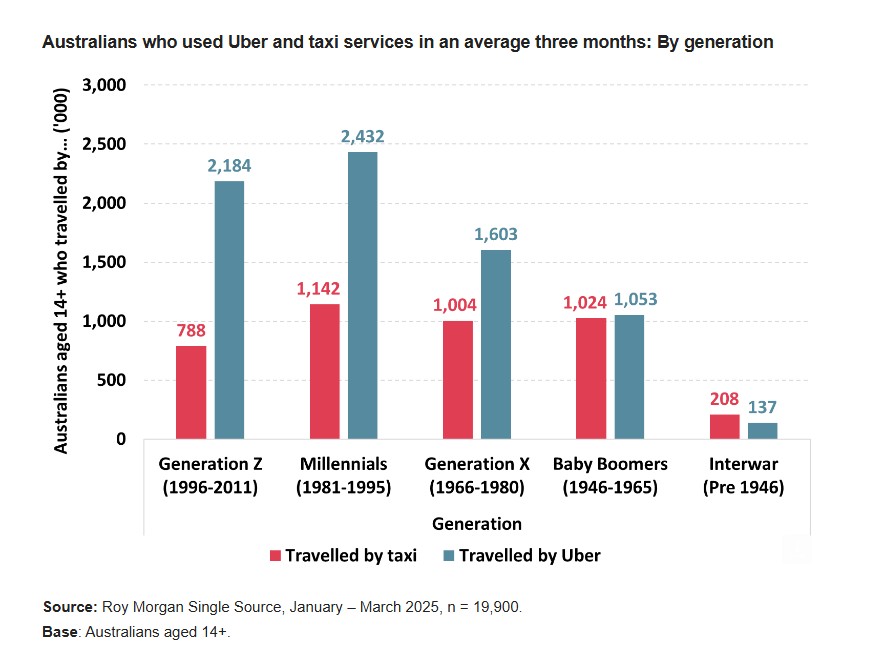

Generational differences in preference are stark. Uber enjoys overwhelming popularity among Australians under 60, especially Generation Z (born 1996–2011) and Millennials (born 1981–1995). Among Gen Z, 2.18 million (39.7 per cent) use Uber compared to just 788,000 (14.3 per cent) who use taxis. Millennials remain the largest group of Uber users, with 2.43 million (40.5 per cent) preferring the service, more than double the 1.14 million (19 per cent) who choose taxis.

Generation X (born 1966–1980) also favours Uber, with 1.6 million users (33 per cent) compared to 1 million (20.7 per cent) taxi users. Baby Boomers are split almost evenly, while only the Interwar generation (born pre-1946) continues to prefer taxis, with 208,000 users (19 per cent) compared to Uber’s 137,000 (12.5 per cent).

The findings come from Roy Morgan’s Single Source survey, one of the country’s most comprehensive consumer studies, based on over 65,000 interviews annually. The growing divide between Uber and taxis reflects shifting consumer behaviour and evolving transportation preferences across generational lines – with convenience, app-based booking, and pricing playing key roles in the evolution of Australia’s ride service landscape.