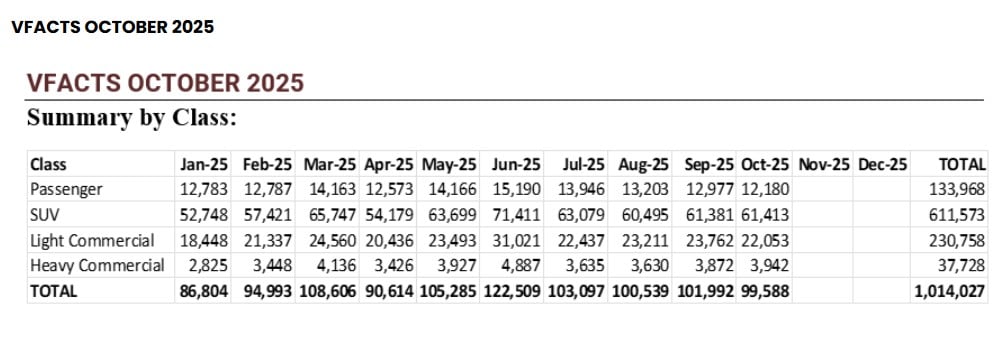

Australia’s new vehicle market held steady in October, with 99,588 cars sold – a modest 1.2 per cent increase on the same month last year. Despite the stable monthly result, year-to-date sales reached 1,014,027 vehicles, down slightly (1.1 per cent) compared to the same period in 2024.

The most notable development for the month was the rapid growth of hybrid and plug-in hybrid (PHEV) models, signalling a continued shift in buyer preferences toward electrified powertrains.

Hybrid vehicles accounted for 17.8 per cent of total sales, up 25 per cent from October 2024, while PHEVs rose 95 per cent to claim 4.7 per cent of the market. Battery electric vehicles (BEVs) made up 7.3 per cent, maintaining a stable share. Across the first ten months of 2025, hybrid sales are up 12 per cent, while PHEVs have surged 137 per cent.

Federal Chamber of Automotive Industries (FCAI) chief executive Tony Weber said the data confirmed that Australian drivers are embracing electrified technology at an accelerating pace.

“The October results show Australians are increasingly choosing hybrid and plug-in hybrid models as a practical path towards lower emissions,” Mr Weber said. “Hybrids are delivering strong growth right across the market, while petrol-only vehicles continue to lose ground.”

SUVs again dominated buyer demand, making up 61.7 per cent of all vehicles sold. Medium SUVs –Australia’s favourite vehicle category – accounted for one in every four new cars delivered. Passenger vehicles, by contrast, represented only 12.2 per cent of the total market, underscoring the ongoing consumer preference for larger, more versatile vehicles.

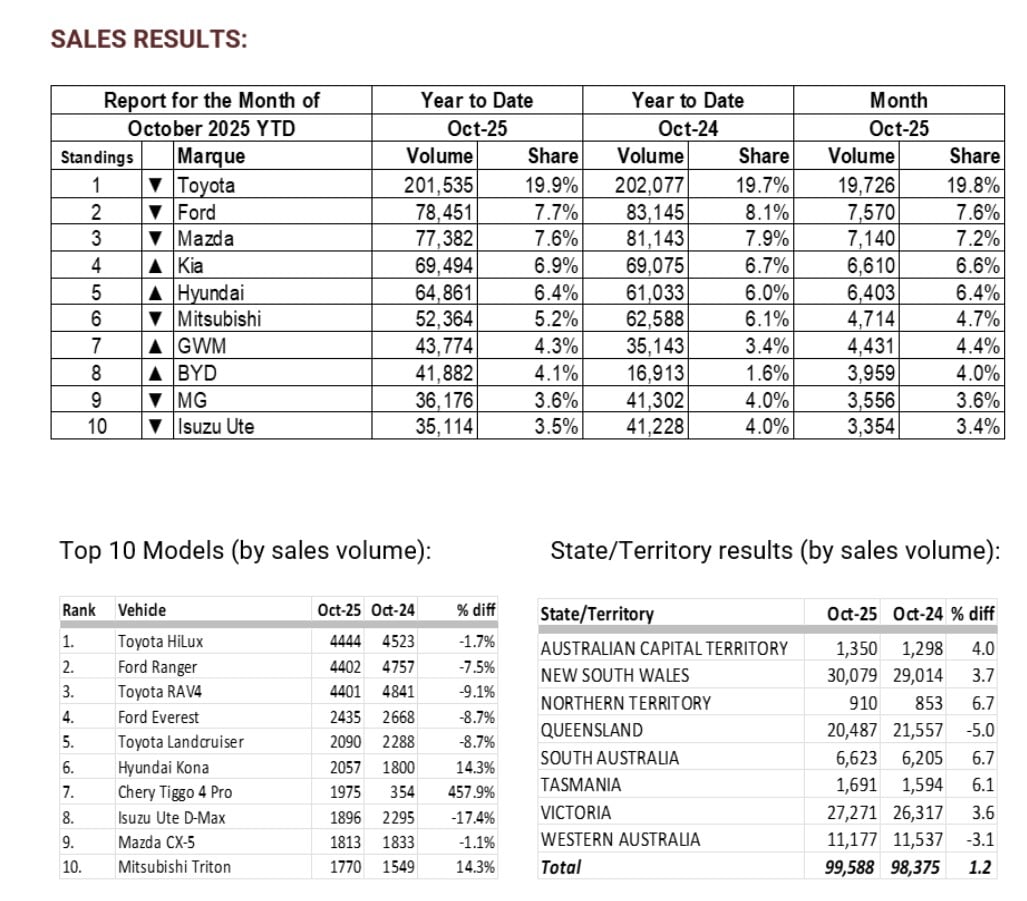

Toyota maintained its commanding position at the top of the sales charts with 19,726 vehicles sold, ahead of Ford (7,570), Mazda (7,140), Kia (6,610), and Hyundai (6,403). The Toyota HiLux, Ford Ranger, and Toyota RAV4 were separated by only a handful of units, reinforcing their dominance as Australia’s favourite models.

Chinese-made vehicles (GWM Haval H7, main image) also continued their upward trajectory, with sales up 40 per cent year-on-year, solidifying China’s place as the third-largest source market. Four Chinese brands featured among October’s top ten.

Across the states and territories, results were mixed. The ACT, South Australia, Tasmania, and Victoria all recorded solid growth, while Queensland and Western Australia posted modest declines.

Despite the small monthly lift, the latest figures highlight an industry in transition – one increasingly defined by electrification, SUV dominance, and changing consumer priorities.

We recommend

-

News

NewsVFACTS August 2025: Vehicle sales hit 100,000 as Chinese brands break into Top 10

BYD, GWM, MG and Chery among Australia’s leading marques, with SUVs maintaining dominance across the market.

-

News

NewsChinese carmakers surge in UK – while new report predicts they will soon dominate Aussie roads too

Brands such as BYD, Chery and MG are fast rising up the sales charts in the UK - while a new report predicts they will dominate new car sales in Australia by 2035.