We will still have a car industry to proud of when Ford, Holden and Toyota close their doors. Meet the visionaries driving Australia’s automotive future.

NOTHING focuses the mind like knowing you are going to be hung in the morning,” John Conomos deadpans.

The now semi-retired auto industry veteran (below), who played a key role in Toyota’s rise to the top in Australia, is making the point that if you want to be involved in the car industry and base yourself in Australia post-2017, you’d better have your plans in place now.

They know that when the lines grind to a halt at Ford in 2016 and then at Holden and Toyota in 2017, it will be the end of an era. But they want to be part of an auto industry that continues on, albeit one that will survive on a much smaller scale, without substantive government assistance or local production.

The change will be so great that in 2018, unless a start-up like Ethan Automotive overcomes massive odds and makes it to the start line, there will be just one company left in Australia that has the ability to design, engineer, assemble and market cars locally, and that’s the Walkinshaw Automotive Group, which includes Holden Special Vehicles. It’s a company aware of the risks and difficulties of the car industry, not least because it is based in the old Nissan plant, in the south-eastern Melbourne suburb of Clayton, which churned out its last Pintara in 1992.

Essentially, he argues, once the multinationals have vacated the field of battle, he will own it. So while he is emphatic HSV will continue in some form beyond the end of the Commodore, he intends to pursue other brands as well.

“We are going to be the only engineering and manufacturing house in Australia, so we can offer the manufacturers who are importing here something no one else can, which is a turn-key solution to try and get unique products into the market,” he explains. “We can do it with incredibly short timelines, which we have demonstrated plenty of times.

“We have got a very good supplier base and a commercial model that works very, very well, which has been tried, tested and proved with Holden for a significant period of time. Now we have the opportunity to go in and speak to everyone else and ask what can we do and what value can we add to their business.

“The guys who are going to be left behind are the ones who don’t create anticipation for their brand and don’t create any differentiation.”

“We have a fair idea of where it is going and the details of that are probably what is keeping a few people up at night,” he admits. “But we are pretty confident in what we are doing and what we want to do. And to be honest we’re pretty excited about it.”

There is a certain irony in this being a path already well trodden by HSV’s crosstown rival, Premcar. The company formerly known as Prodrive Automotive Technology, which cut its teeth developing Ford Performance Vehicles Falcons, has had a presence in China since 2005, and also performs engineering and vehicle validation work in India.

Once a direct subsidiary of Prodrive UK, it is now locally owned by a group of Australian engineers who have had to adjust from developing 330kW rear-drive V8 muscle cars for FPV to economy cars for Chinese brands Geely, Lifan and the like.

Premcar still does work for Ford and other customers in Australia, with links into the Blue Oval’s regional development programs in Australia and internationally. But it has also diversified. Premcar recently developed a wet-brake design for mining trucks for a US company, and also works within the defence industry and others.

This jack-of-all-trades approach is the only way to keep an Australian address and stay in the auto industry, according to chief engineer Bernie Quinn.

“It’s worth doing because we’ve got all the guys we have had employed and we are still winning work,” Quinn says. “But to say it has been a challenge – an ongoing challenge actually – is an understatement. Resilience is the key.

“In the last 12 months we have seen a moderate turnaround in the amount of engineering work in Australia and we are riding the back of that, as well as the expected growth in China. We are spending more time here and have been able to add to our headcount.”

Premcar’s Asian business is just the sort of activity Conomos says Australian automotive companies need to undertake to survive. As well as the obvious targets of China and India, he rates Indonesia and Malaysia as emerging markets that need Australian expertise.

“We are good at black-box engineering, we are good at development,” Conomos insists. “So the combination of our know-how and their (Asian) potential volume is pretty exciting for those who wish to become involved and wish to become global.”

Conomos knows of what he speaks. For the past five years he has acted as an ambassador for the Australian automotive industry, heading trade missions and knocking on doors throughout the region. His role has only recently been terminated by the federal government, which has instead thrown that budget into the $155 million pot known as the Growth Fund, which is designed to ease the ‘transition’ – love that word! – of employees and companies away from car manufacturing into something else.

Mark Albert is the sort of entrepreneur Conomos knows will have a go. He already has. Albert is managing director of MTM Automotive Components, a family owned tier-one supplier established by his father, Max, in 1965 in the Melbourne suburb of Oakleigh. While the multinational suppliers will walk away when the cars and money stop flowing, MTM – and a few other locals – will still be here.

“I like Australia,” Albert laughs. “We are one of the few manufacturers growing in the current environment … I am quite positive about the future.”

Nowadays MTM also services the Ford Ranger programs in Argentina, Thailand and South Africa.

“It took us five or more years to land our first international orders … we’d gone to Asia, we’d gone to Europe and we were in North America; GM at that point had a problem and we could fix the problem.”

MTM has also diversified beyond its traditional automotive base, including manufacture of the Tomcar all-terrain vehicle (driven by Albert below) originally developed in Israel. It also has a plant in China that is an adjunct to its Melbourne plant, not a replacement.

“You need to be tenacious and you need to be bloody-minded to survive here,” Albert says. “You have to get out there on the front foot and that means you have to look forward.”

Walkinshaw Automotive Group

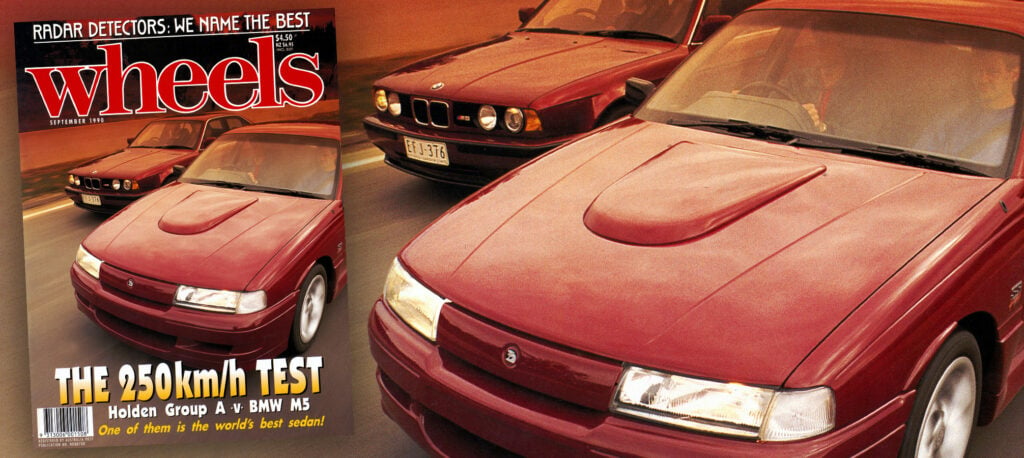

THE Walkinshaw Automotive Group traces its ancestry in Australia back to 1987, when Tom Walkinshaw did a controversial deal with Holden to replace Peter Brock, the Holden Dealer Team and HDT Special Vehicles.

Since Tom’s death in 2010, son Ryan has become the company’s leader and driving force. The highly successful Holden Special Vehicles division is the star act and biggest single entity, employing 115 people to design, engineer, manufacture, market and sell the performance V8 sports sedans it develops from the Holden Commodore.

Walkinshaw Racing employs 65 staff to construct and race four Holden Commodores in the V8 Supercars Championship. Two of these cars form the Holden Racing Team, the most successful team in the history of Australian touring car racing.

Walkinshaw Performance designs, manufactures and sells aftermarket performance parts and vehicle enhancements, employing 15 staff. It also supports motorsport activities.

The most recent addition to the group is Fusion Automotive, which has a staff of 10 and imports, distributes and sells the Indian-made Tata vehicles in Australia.

Each organisation runs as its own entity, but there is cross-pollination of talents and skills. For instance, HSV and HRT operate closely together. The group’s turnover was put at $160 million in 2013.

Performax International

ESTABLISHED in 1989, Queensland-based Performax is Australia’s largest converter of American trucks and high-performance cars to right-hand drive.

It has done more than 3000 conversions and within three years plans to raise its annual production rate from around 300 cars per annum to 450.

It has gained full volume-manufacturer compliance, enabling it to convert the iconic 12th-generation F-Series truck for the local market and sell it without restriction.

With a starting price of $115,000, it’s an attractive business, but Performax admits gaining that accreditation has required an even higher production quality.

It has started importing and retailing the Chevrolet Silverado and GMC Denali under the same arrangement.

“We think there would be a degradation of quality of vehicles put out in the marketplace,” he says. “We would not like to see any dilution of the current framework.”

Performax is the dominant player in the Australian market, with a 65 percent share and a turnover of more than $75 million a year. It has around 100 employees and a plan to grow that to 110.

It has also developed a national dealer network to sell its products, a servicing facility within its Gympie base, a new retailing facility in Brisbane, and offers a four-year or 120,000km warranty on its vehicles.

The company supplies conversion kits to South Africa and has exported completely built-up vehicles.

PWR Performance Products

IN INTERNATIONAL motorsport, PWR is just about unavoidable.

From its Ormeau development and manufacturing facility on the Gold Coast it supplies cooling products to teams in championships across the globe.

That list starts with Formula One, where it claims 90 percent of the field including Red Bull and Ferrari. There’s the World Endurance Championship, World Rally Championship, NASCAR, IndyCar, the German DTM and more. Back home in Australia PWR last year celebrated its fourth straight V8 Supercars championship with Jamie Whincup and Triple Eight.

PWR now has 95 employees and revenue of more than $20 million last year. In March, it bought US‑based cooling system maker C&R Racing, giving it an even bigger foothold in US racing.

While racing is the high-profile activity, PWR also services the aftermarket, military, industrial and off-road markets.

High-performance road cars are now a target as well, including the Nurburgring lap-record breaking Porsche 918 Spyder hybrid supercar, which comes standard from Porsche with the full PWR cooling package.

The not-so-big three

CLARIFYING the exact size of Ford, Holden and Toyota beyond 2017 is impossible, not least because they admit they don’t know themselves what their post-manufacturing footprint looks like.

What we do know is all three organisations will include sales and marketing and after-sales divisions – the bits required to sell cars here whether you build them locally or not.

Toyota has confirmed the closure of its Sydney base and centralisation of its Australian HQ to Melbourne, and that its Australian workforce will drop from 3900 to 1300. Ford will shift its administrative base from Campbellfield in Melbourne’s north to inner-city Richmond.

In all three cases some form of design and engineering capability has been retained. Ford’s commitment is the most comprehensive, including 1500 staff employed across a design centre at Campbellfield, an engineering centre in Geelong and the proving ground at the You Yangs. That will make the Blue Oval the largest automotive employer in the country post-2017.

GM will retain a design centre, engineering capability and the Lang Lang Proving Ground, but its head count in these areas is unlikely to nudge beyond a couple of hundred.

Toyota will also retain its small design studio in Australia and some form of engineering presence, but the tech centre established with so much pomp in 2005 will not be retained in its current form.

Nissan Casting Australia

FIRST out, last in. That’s the story for Nissan Australia. It bailed out of local car manufacturing in 1992 yet, once everyone else leaves by the end of 2017, it will be the sole OEM still manufacturing in Australia.

That will be via its Dandenong casting plant, which was established in 1982 and at this stage at least has no visible end date.

As a sign of Nissan’s ongoing commitment, a new tower furnace was installed in the first half of 2013 at a cost of $1.868 million, a third of that supplied by federal government investment programs. The furnace has a forecast working life of 20 years.

In April, Nissan revealed it had won new work to make driveline components for soon-to-be-released new models, new motor technology, and all-new propulsion systems that are yet to be announced.

So how does this one small plant survive when every other manufacturing facility owned by a multinational car company will soon shut down?

It’s nice to know nearly all Nissan and Infiniti vehicles sold in Australia have locally produced parts, arguably making them as Aussie as any cars will be post-2017. If you want to make sure, just go hunting for the kangaroo logo in the casting.