Snapshot

- Lucid and Faraday list on the NASDAQ

- Lucid Raises $4.5bn

- Faraday Future raises $1bn to escape bankruptcy

It seems odd to call either Lucid or Faraday Future a startup given how long they’ve been on the scene, but neither have yet moved into the next phase – scale up – that a certain EV rival managed with spectacular results.

Timing is everything in any business, and some of Tesla’s fortunes rest on a number of factors, which include exceptionally generous government loans (since repaid) to get the company over the line and selling cars at scale. Their CEO knows how to get attention, too, sometimes of the right kind.

Faraday and Lucid have not had that kind of good fortune. Lucid has laboured for years to commercialise and productionise its EV technology while Faraday has been the subject of various legal battles and a sketchy founder’s methods. Both, however, recently arrived at the point where they had to look for a novel – but increasingly common – method of fundraising.

Lucid recently completed a merger with a Saudi Arabia-funded company called Churchill Capital IV (CCIV). CCIV is based in California and was formed with the express purpose of merging with an existing business in need of fundraising and is known as a Special Purpose Acquisition Vehicle or, SPAC.

SPACs provide the opportunity for what is basically a reverse merger, where a company is at a stage ready to go ‘live’ but needs a considerable sums of money to do so. A SPAC is essentially a shell company with open, ready arms and a bunch of lawyers with money and paperwork, ready for the complicated process of an initial public offering (IPO).

Lucid’s recent history has been a difficult one. Originally founded in the mid-2000s as a battery company, it morphed into an EV company called Lucid Motors the same year as Faraday Future first appeared at the Consumer Electronics Show, 2016.

Subsequent wrangling over its ownership (which included rival Faraday’s founder Jia Yueting’s almost one-third stake), deals with various hedge funds, a Chinese bus company and then – seemingly ironically – the sovereign wealth fund of oil-rich Saudi Arabia, all made the business of making and selling cars nearly impossible.

The final piece of the puzzle was a fraught NASDAQ listing worth $4.5 billion. Fraught because it was partly funded by share sales to inexperienced investors who weren’t aware they had to vote on certain things to get the listing over the line. Encouragingly for Lucid, the pre-IPO shares were hot property as the final raising figure shows, and the presence of big money backer, the Saudi Arabian Government, encouraged investors.

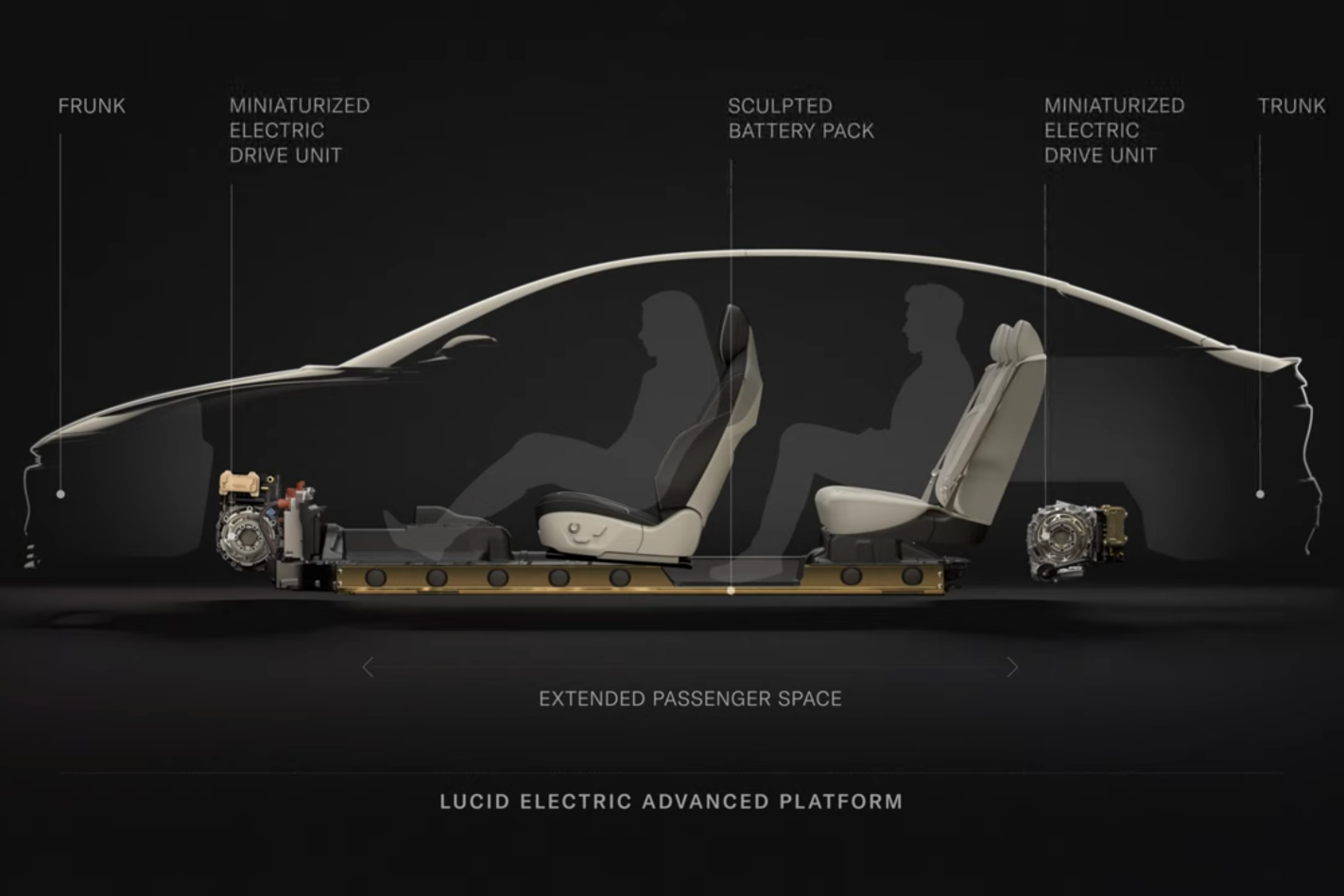

With this huge injection of funds, former Tesla Model S lead program engineer and Lucid CEO Peter Rawlinson can press on with building a factory and delivering the Lucid Air sedan to customers with its absurdly powerful 1000 horsepower drivetrain and luxurious interior. Its next EV in development is predictably an SUV called the Gravity.

The Lucid Air is well advanced, with 1000 pre-production models built and plenty of buzz on social media about its performance and technology. The company regularly hosts ride-alongs, and as development has progressed, so has the positive coverage. One variant of the Lucid Air has a 113kWh battery with a claimed driving range of more than 800km on a single charge and a US$139,000 (AU$189,000) price tag.

Faraday Future is a much younger company. Founded by Chinese billionaire Jia Yueting, the company has staggered from one PR disaster to another after its original unveiling at the 2016 Consumer Electronics Show in Las Vegas.

Like Lucid, its path to producing vehicles is full of ownership dramas, dried-up cashflow and in Faraday’s case, very public and very ambitious broken promises. Its first CES outing in 2016 was with a static concept car bearing no relation to the car it showed in 2017. That 2017 outing was not well received as the back story leaked out from disgruntled employees and it became clear the car was not operational as had been claimed.

Rumours that the company was actually an attempt by Apple to develop an EV by stealth were wide of the mark, particularly given Jia’s history of comparing the computer giant to Hitler in advertising for another tech venture. Jia committed to building a $1 billion factory in Nevada which was never completed but managed to hire 1500 people and raise almost a billion dollars in loans which eventually led to legal action against him.

Jia then talked Chinese real estate megacompany Evergrande into fronting $800 million out of a total $2 billion agreement, spent it much faster than forecast, then asked for more. It all ended up in court in Hong Kong and eventual bankruptcy protection for the company, which resulted in fired workers, a restructuring and the sale of its headquarters.

In 2018 the company looked finished as it all but disappeared from view. US bankruptcy regulations being what they are – and the considerable amount of valuable intellectual property to offer potential investors – Faraday took a similar approach to Lucid’s, and raised a billion dollars via a SPAC arrangement.

Faraday Future’s new CEO, Carsten Breitfeld, is the company’s answer to Lucid’s Peter Rawlinson. Breitfeld is an experienced program lead (he ran BMW’s i8 program) and is seen as a rather safer pair of hands than the now-bankrupted Jia. Having a CEO who isn’t under investigation by the US SEC helps when you’re raising money.

The SPAC arrangement means Jia has been effectively sidelined and his shareholdingis now an arm’s-length arrangement with no power over Faraday’s day-to-day operations. Part of the listing also means creditors have converted debt to equity in the hope a successful Faraday will see a return on their involvement.

Both Lucid and Faraday Future can now get on with the business of building and selling their promising looking electric vehicles.

We recommend

-

News

NewsLucid boss test drives own car, loves it

Lucid chief's first drive of his own car yields unsurprisingly positive review, with some tuning insights too

-

News

NewsEverything we know about the Lucid Air

Tesla-challenging EV maker Lucid takes flight with production Air reveal

-

News

NewsVIDEO: Faraday Future’s incredibly awkward parking fail at CES

The Chinese electric vehicle start up didn’t make the most convincing debut of its self-parking feature