Snapshot

- 7/10 South Aussies said a tax on EVs would put them off buying

- Generally those surveyed were in favour of electric vehicles

- SA hasn’t yet brought proposed rules into force

Seven out of 10 South Australians say the State Government’s proposed road user charge makes them less likely to buy an EV, according to a leading think tank.

New research from The Australia Institute shows that South Aussies would be less likely to make the switch to an electric vehicle if the State Government proceeds with its plan to copy Victoria’s EV Tax.

However, the Australia Institute survey of 599 South Australians did not find that overall support for electrification was lacking – with many showing support across the political spectrum for incentives to reduce the upfront cost of an EV.

Four in 10 people surveyed said they are considering making their next car an EV, while seven in 10 supported the Government reducing the cost of EVs through subsidies and/or stamp duty waivers as seen in other states and territories.

“Many South Australians are considering making the switch to an electric car, but the State Government’s proposed EV Tax will pull the handbrake on that enthusiasm,” said Noah Schultz-Byard, SA Director at The Australia Institute.

“Our research shows that the vast majority of South Australians want more EVs on the road, not less, because they are considered to be good for the climate, health and the environment.”

“Incentives to reduce the upfront cost of an EV, such as subsidies or stamp duty waivers, are very popular among South Australian voters across the political spectrum.

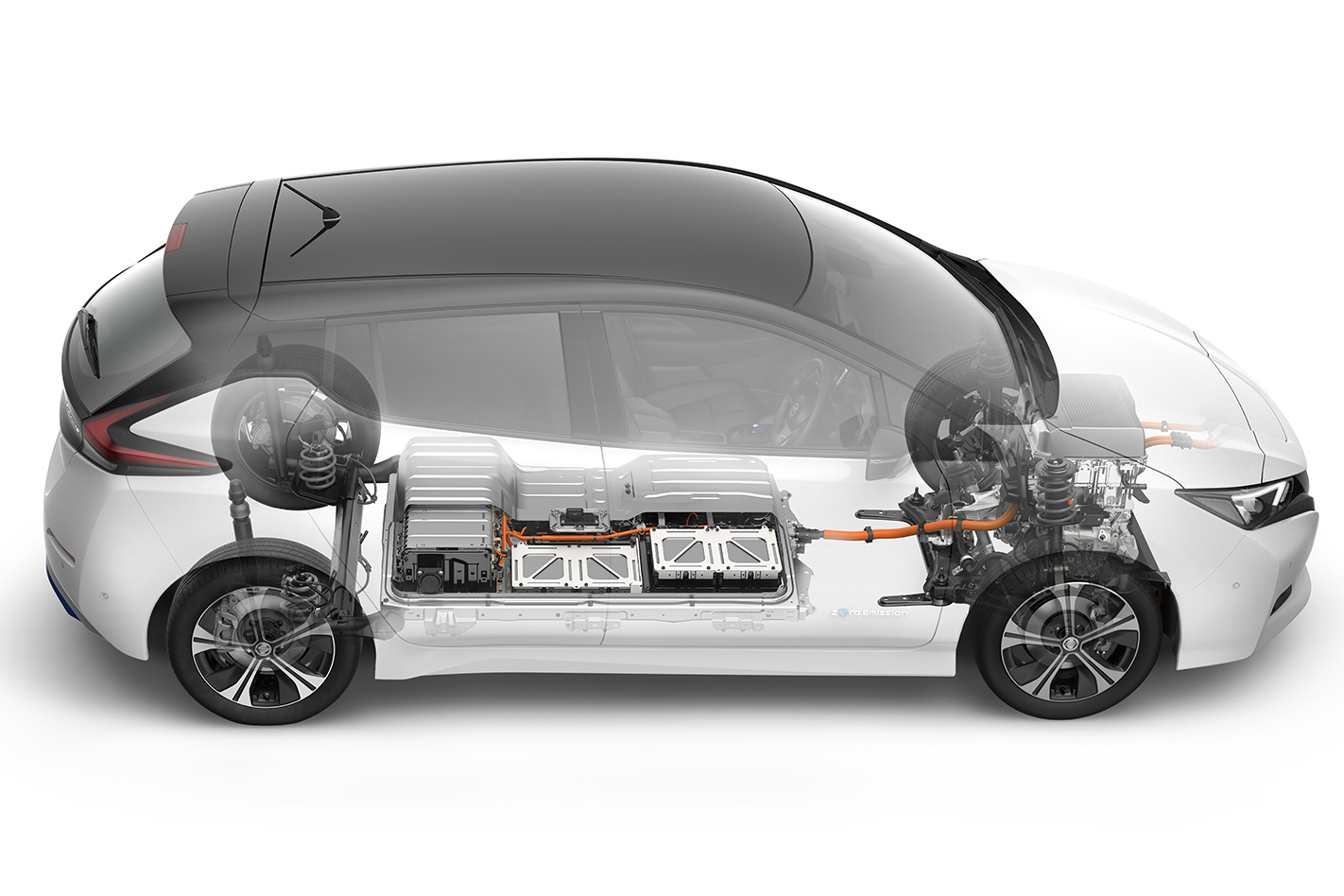

“South Australia is leading the nation with its adoption of wind and solar power, but those efforts will be badly undermined if the government moves ahead with its EV Tax. Tailpipe emissions in South Australia remain high and, in light of the IPCC’s latest report on the state of the climate, we should be doing all we can to switch to zero-emission vehicles.

“The South Australian Government should do a U-Turn on its plans to introduce a Victorian style EV Tax.”

While SA was the first state to put forward the idea of taxing electric vehicles on our shores, it is by no means alone. Victoria has come under fire for its own policy which brought in a road user charge from July 1, 2021.

As a result, EV owners must now pay 2.5c/km for a battery electric vehicle (BEV) or 2c/km for a plug-in hybrid (PHEV).

Victoria, however, does offer incentives alongside this, including; a $3000 subsidy for the first 20,000 EVs or fuel-cell electric vehicles (FCEV) sold costing under $68,750, reduced stamp duty and a $100 discount on registration fees annually.

Meanwhile, NSW also has a similar charge in the pipeline – but it won’t come into effect until EVs make up 30 per cent of the market, or July 1, 2027, whichever comes first.

Additionally it is offering a $3000 rebate for the first 25,000 EVs or FCEVs sold costing below $68,750 and waiving stamp duty for vehicles under $78k from September 1 this year.

SA first revealed it was considering a tax on EVs in its budget in late 2020, but has put plans on hold until next year to watch what happens with other states first.

“The Government is intending to introduce a road user charge for plug-in electric and zero emission vehicles,” the budget document said. “The charge will include a fixed component (similar to current registration charging) and a variable charge based on distance travelled.

“Electric vehicles do not attract fuel excise and therefore make a lower contribution to the cost of maintaining our road network. The proposed road user charge will ensure road maintenance funding is sustainable into the future.”

While finding replacement funding for ‘lost’ fuel tax makes sense to enable ongoing road maintenance and development, the SA government has not explained if the charge takes into consideration the tax already paid by EV owners to charge their vehicles with power from the grid.

Speaking at the time the proposal was announced, Behyad Jafari, CEO of the Australia’s EV Council, said: “It’s like responding to a drop in the tobacco tax take by slamming a new excise on nicotine gum.

“If the revenue from fuel excise is falling because South Australians are burning less foreign oil, that should be considered a blessing. Overall it’s good for air quality, it’s good for the health budget, it’s good for carbon emissions, and it’s great for economic sovereignty. The last thing any sane government would do is try to hit the brakes on this trend.”

“We shouldn’t be talking just about EVs – we should be talking about major automotive tax reform,” the Federal Chamber of Automotive Industries’ Chief Executive Tony Weber recently told Wheels.

“At the moment we have a whole host of taxes on our cars – there’s GST, stamp duty, rego, the licence fee, the fuel excise and in some cases the LCT. We could eliminate all of those and just have one single, nationally consistent, charge based on how many kilometres you drive in a year, regardless of what technology cars have.

“The problem we have here is the fuel excise is collected by the Federal Government but now the road user charges are being/will be paid to the individual states.

“In an ideal world the Government would be [centralising vehicle taxation] now, but it’s still something we could plan for in the future. There’s a very real danger if the six states and two territories go it alone, the red tape to undo all that would be too substantial. The longer the Federal Government is inactive in this space the more difficult it is going to be to deal with.”

South Australia’s Department for Energy and Mining has been contacted for comment.

We recommend

-

News

NewsAustralia's EV policies: What's happening in each state and territory in 2021 – UPDATED

It's every state and territory for itself as the Federal Government declines to take the lead on EV policy. Here's the current state of play

-

News

NewsSouth Australia wants to tax EV use

South Australia follows New South Wales with proposed rego-style electric vehicle distance charge that critics say will set-back EV uptake

-

News

NewsSA govt aims to flood local vehicle market with EVs

South Australia is building a statewide fast-charging network and transitioning the government vehicle fleet to EVs