Australia’s CO2 standards are widely considered to lag behind the rest of the developed world’s.

We have no legal fuel-efficiency targets and no national plan to ban the sale of new fossil-fuel-powered cars by a certain date.

But in recent months, since Labor came to power in May 2022, there has been some movement – with changes to import tariffs, Fringe Benefits Tax and a federal strategy in place offering $2000 off the cost of buying an electric vehicle.

But how do we really compare on paper to what is happening in the rest of the world?

We’ve broken down the legal commitments and policies of the major players here all in one handy guide.

Australia

Current CO2 target

Following Labor’s election in May, Australia submitted a stronger target in June 2022 of a 43 per cent reduction of greenhouse gas emissions by 2030 below 2005 levels. The new target submitted presents a higher level of ambition.

Previous target

In a prior update under Scott Morrison’s administration, Australia submitted an updated target October 2021 – which was no improvement from its 2016 goal that was a 26-28 per cent reduction of greenhouse gas emissions by 2030 below 2005 levels.

Internal combustion engine ban

At present, Australia as a whole does not have a timeframe set for stopping sales of new petrol and diesel cars. However, the ACT plans to phase out light internal combustion engine vehicles from 2035 – the first jurisdiction to set a date – meanwhile in NSW an urban policy think tank, Committee for Sydney, is proposing all new cars sold in the city must be electric by 2027. The latter is not a Government-backed strategy.

EV incentives

Each state and territory now offers some kind of incentive, which are detailed in full here.

Policies adopted by NSW and the ACT are considered to be the most progressive, with VIC’s, which includes a road user charge already in effect as of July 2021, conversely regarded as the worst.

Since its election last year, the Labor Government launched its first ever electric vehicle strategy in September 2022, and in November the Treasury Laws Amendment (Electric Car Discount) Bill passed through the Federal Parliament.

This provides up to $2000 off the purchase price of battery-electric and plug-in hybrid vehicles (PHEV), as well as Fringe Benefits Tax (FBT) exemptions for fleets and novated leases. The Government will apply the exemption retrospectively to eligible cars first used on or after July 1, 2022. PHEVs will initially be covered, but the offer will expire on April 1, 2025.

Alongside the removal of the Fringe Benefits Tax the five per cent import tariff for EVs priced under the LCT limit has been cut. The FBT savings amount to $9000 per annum for an employer, or $4700 for an individual with a salary sacrifice agreement for a $50k electric vehicle. Cutting import tariffs drops purchase prices by a further $2500.

New Zealand

Current CO2 target

New Zealand has committed to a new target of cutting its CO2 below 2005 levels by 50 per cent by 2030. In November 2021, New Zealand submitted its new target, but it is still not consistent with the Paris Agreement’s 1.5°C limit.

Previous target

NZ’s prior goal in 2020 was 30 per cent below gross 2005 levels by 2030.

Internal combustion engine ban

In November last year at the COP26 United Nations Climate Change Conference, the UK Government released a document outlining plans to reduce emissions in the transport industry by banning the sale of internal combustion engine vehicles around the world by 2040.

It was signed by a number of countries, including New Zealand, which pledged to ban the sale of new internal combustion engine vehicles by 2040 or earlier – but it’s worth noting that the document is not binding

EV incentives

Over the ditch, New Zealand has been busy for a little while now when it comes to planning for electric vehicles – having already established a national policy and created incentives to drive customers towards the new technology.

New Zealand’s Land Transport (Clean Vehicles) Amendment legislation, more commonly known as the Clean Car Standard, was given the nod from the national parliament last year, and came into effect from April 1, 2022.

The Standard has been designed to encourage the purchase of electric or low-CO2 emission light vehicles by reducing the cost of eligible new and used fuel-efficient ones, while imposing a fee on higher-polluting vehicles. Buyers of fully-electric models can get an NZ$8625 rebate, while for plug-in hybrids the discount is NZ$5750.

A vehicle must have a three-star safety rating or higher and cost less than NZ$80,000 to be eligible.

Any passenger vehicle emitting less than 146 grams of CO2 per kilometre is eligible for a Government rebate, while those that emit 193 grams and higher are subject to a Government fee that rises with their CO2 levels. All others which fall between 146 and 192g/km are in a neutral zone and don’t attract a rebate or fee.

United Kingdom

Current CO2 target

The UK has committed to a 68 per cent reduction below 1990 levels (but 1995 levels for some gases) by 2030, which is a particularly ambitious plan.

Previous target

Prior to this new target made in 2021, the UK had pledged to a reduction of 57 per cent. However, the UK Government’s more recent emissions projections show that, under current policies, it is not on track to achieve its former 57 per cent target, let alone its newly announced 68 per cent target.

Internal combustion engine ban

By 2030, the UK will ban all sales of new petrol and diesel cars in phase 1 of its plan. Phase 2 will see all new cars and vans be fully zero-emission at the tailpipe from 2035.

EV incentives

The UK offers a wealth of incentives for both purchasing and charging EVs. These include:

- EV charger grant for homes: owners of eligible EVs can receive a grant for up to 75 per cent (capped at £350, inc.VAT) off the total purchase and installation costs of one charger for their home. Company cars and leased vehicles are also eligible.

- EV charger grant for workplaces: firms can cover 75 per cent of all purchase and installation costs, up to a maximum of £350 for each socket, for up to a maximum of 40 across all sites.

- Company Tax Benefits: businesses that install charging infrastructure can access tax benefits through a 100 per cent first-year allowance (FYA) for expenditure incurred on electric vehicle charging equipment.

- Local Authorities: can receive a grant to fund 75 per cent of the capital costs relating to the procurement and installation of on-street electric vehicle charge point infrastructure in residential areas for those who don’t have access to off-street charging.

- Purchase grant: with the Plug-in Car Grant, buyers can; receive up to 35 per cent off the cost of an electric car (up to £3000 depending on the model), 20 per cent off an electric motorcycle or moped (up to £1500), 20% off an electric van (up to £8000), 20 per cent off the cost of a large electric van or truck (up to £20,000 for the first 200 orders, after that up to £8000), and 20 per cent off an electric taxi (up to a max. of £7500). Buyers don’t need to do anything as the discount is handled by the dealer at the point of sale.

- Ownership tax: fully-electric vehicles costing less than £40,000 are exempt from annual road tax.

- Company car tax: businesses that buy EVs can write off 100 per cent of the purchase price against their corporation tax liability if the vehicle emits no more than 50g/km CO2 – paying just 2 per cent tax, plug-in hybrids emitting less than 50g/km of CO2 have their company car tax set at 16 per cent – which is 4-8 per cent lower than the tax on diesel company vehicles.

- The UK Government has also started providing EV owners with special green number plates so that they can benefit from local incentives, such as free parking, using bus lanes, and accessing areas cut off for normal vehicles.

Europe

Current CO2 target

The European Union has committed to at least a 55 per cent reduction below 1990 levels by 2030.

Previous target

Prior to this new target made in 2021, the EU had targeted a reduction of 40 per cent. While this stronger 2030 target is a step in the right direction, it is still not enough to make the EU compatible with the Paris Agreement’s 1.5˚C goal. Domestic emissions reductions of between 58 per cent and 70 per cent are needed.

Internal combustion engine ban

In February this year, the European Parliament voted to ban the sale of new cars and vans powered by petrol and diesel engines by 2035.

The move followed members of the European Parliament voting against an earlier proposal to lessen the goal of a 100 per cent reduction in emissions by 2035 to 90 per cent.

EV incentives

A number of EU member states have their own EV incentives on offer. A country-by-country guide is available here.

United States

Current CO2 target

The United States has committed to a 50-52 per cent reduction below 2005 levels by 2030. This can be translated to a reduction of 40-43 per cent below 1990 levels. In August 2022, President Biden signed into law the Inflation Reduction Act (IRA), the most ambitious and potentially impactful climate policy in US history.

Previous target

While considerably stronger than the previous US Paris Agreement target, which was 26-28 per cent by 2025, this new US goal is still short of a 1.5˚C compatible 2030 target.

For the US, an emissions reduction target of 57-63% below 2005 levels by 2030 would be consistent (assuming the US would also provide support to developing countries to reduce emissions) and would put the country on a better track to achieving its 2050 net-zero emissions target.

Internal combustion engine ban

At present, the US as a whole does not have a timeframe set in stone for stopping sales of new petrol and diesel cars. However, the state of California last month set its own ban for 2035, as well laid out plans which require 35 per cent of new passenger vehicles sold by 2026 to produce zero emissions, then 68 per cent by 2030 and ultimately 100 per cent five years after.

The move is being hailed as a major victory that could point the way forward for others. It gives the most populous US state some of the world’s most stringent regulations for transitioning to electric vehicles.

EV incentives

Following the passing of the Inflation Reduction Act, the US now offers a much greater number of incentives for both purchasing and charging EVs. These include:

- Tax credit changes: EVs placed into service after December 31, 2022, the Inflation Reduction Act extends the (up to) US$7500 EV tax credit for 10 years. The exact amount of the credit will be based on a calculation that considers factors like the where the vehicle’s parts come from and where it is made.Additionally, used EVs (must be at least two years old) will now have a separate tax credit of either up to US$4000 or 30 per cent of the price of the vehicle, whichever is less. However, a previously owned EV can’t qualify if it’s purchased for resale.

But if you’re single, and your modified adjusted gross income is over US$150,000, you won’t qualify for the EV tax credit. The income limit for married couples jointly is US$300,000.

- Pricing eligibility/purchasing: Vehicle price and type also matters. Vans, pick-up trucks, and SUVs with a manufacturer’s retail suggested price (MSRP) of more than US$80,000, won’t qualify for the credit. For cars to qualify for the EV tax credit, the MSRP can’t be more than $55,000.

A used clean vehicle will only qualify for the tax credit if it costs $25,000 or less.

- Charging credits: The Inflation Reduction Act also revives a credit for electric vehicle chargers that initially expired on December 31, 2021. A business that installs an EV charger (and meets certain labour and construction requirements) can benefit from a tax incentive of up to 30 per cent of the total cost of equipment and installation. Previously the limit on the amount of the credit was US$30,000 (which applies to projects completed before the end of 2022). Now, if you complete the installation project after 2022, the tax credit, per property item, is up to US$100,000.

Also, beginning next year, the tax credit for business and home installations will apply to other EV charging equipment, like bidirectional charging equipment.

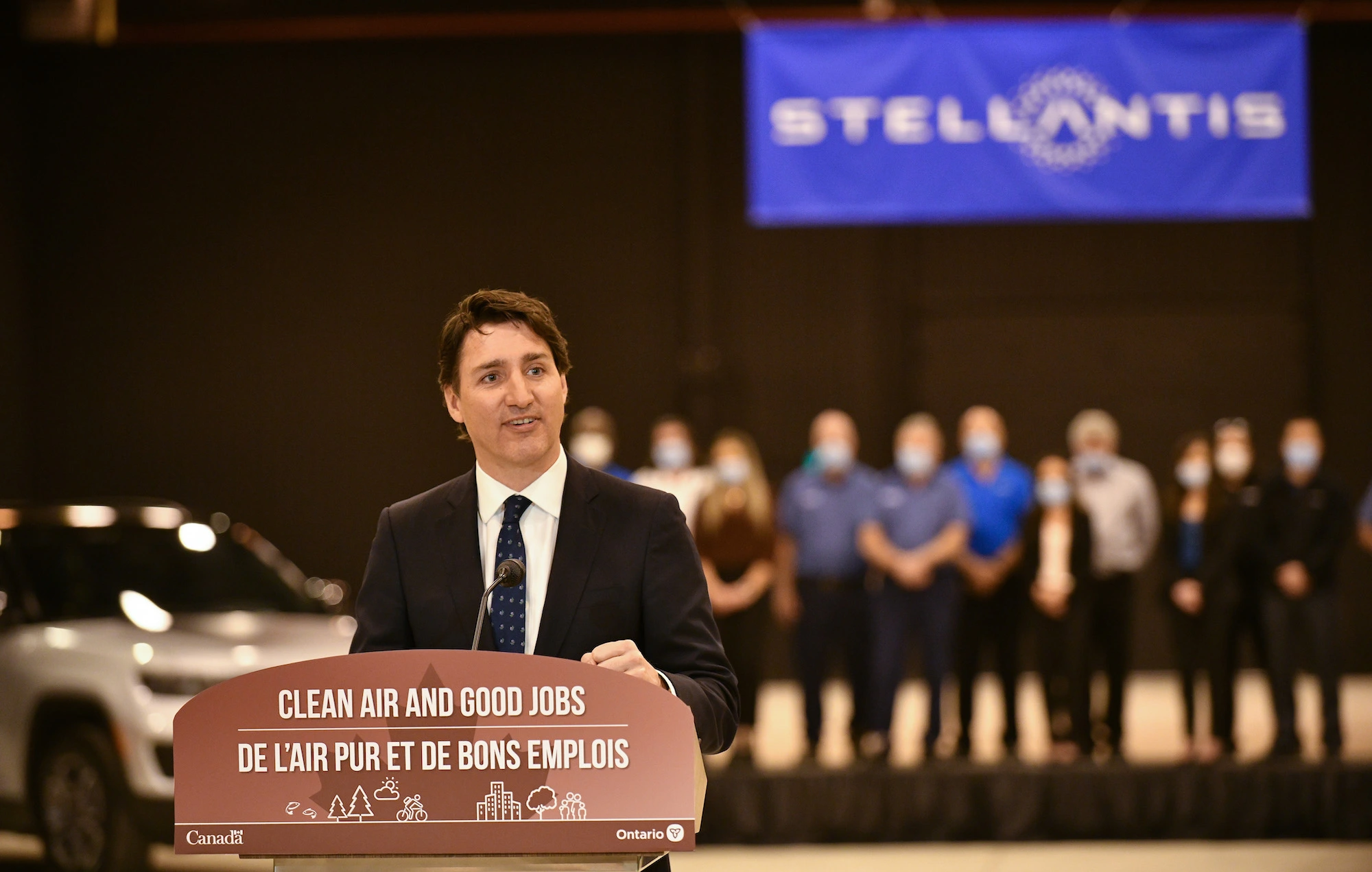

Canada

Current CO2 target

Canada plans to reduce its CO2 to ‘at least’ 40-45 per cent below 2005 levels by 2030, suggesting that it could go beyond this. While the ‘at least’ is an improvement, in reality Canada would need to reduce its own emissions by at least 54 per cent by 2030 for its national emissions to be 1.5°C compatible.

Previous target

Canada’s previous target was the same, minus the addition of ‘at least’.

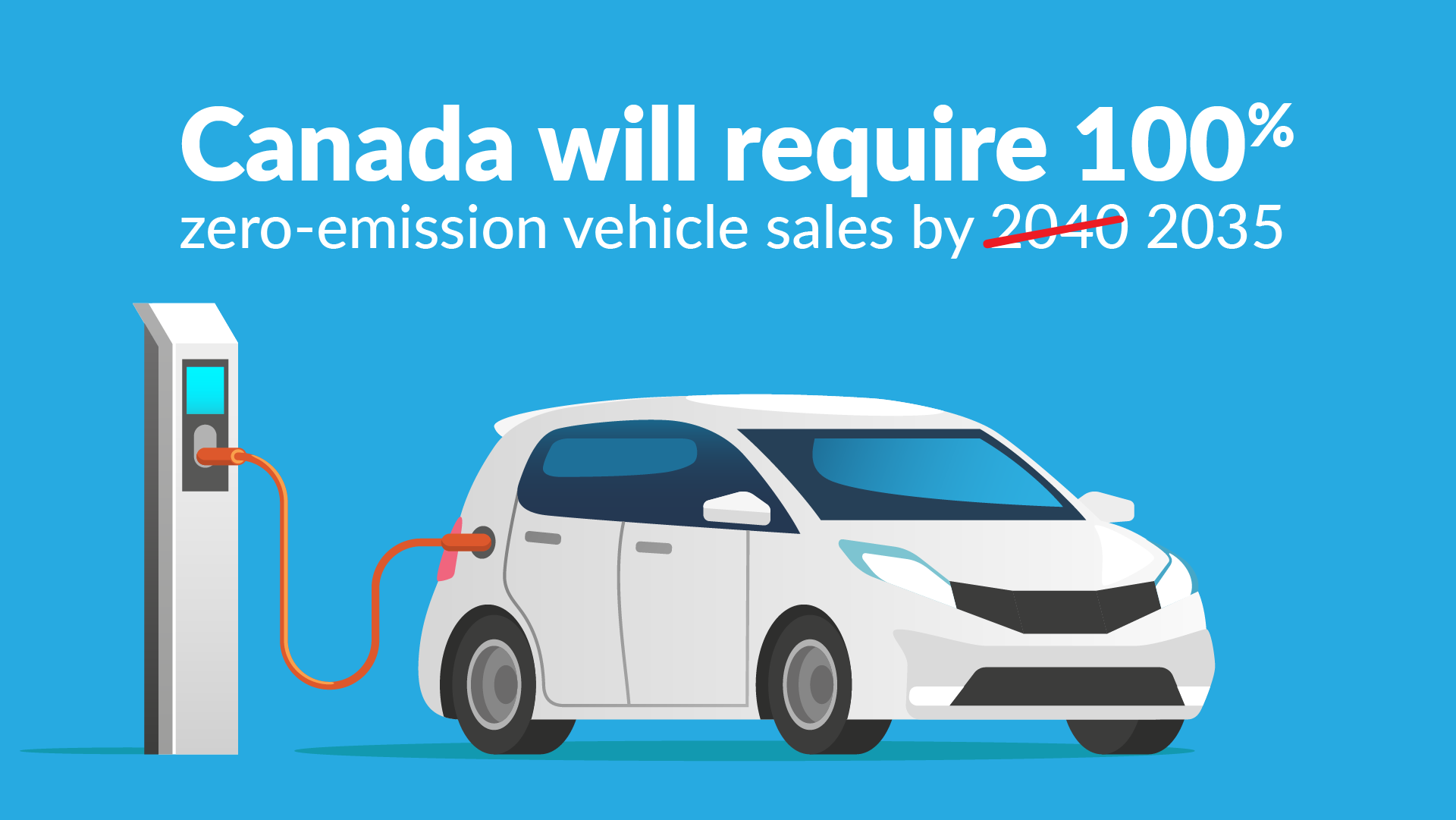

Internal combustion engine ban

EV incentives

Canada offers two incentives, a discount applied at the point of sale, and a tax write-off for businesses.

Under the scheme, buyers can claim the subsidy for new eligible vehicles (including demos as long as their odo is under 10,000 kilometres) – which are either a passenger car where the base model is priced less than CA$55,000 and higher trims cost up to a maximum of CA$65,000, or wagon, SUV, van or ute where the entry-level version is less than CA$60,000 and higher spec variants cost up to CA$70,000.

Fully-electric, hydrogen, or long range plug-in hybrids (50 kilometres or more) are eligible for a CA$5000 rebate, while shorter range plug-ins get CA$2500.

All vehicles must be meant for use on public streets, roads, and highways and have at least four functioning wheels.

Incentives can be applied to EVs leased for at least 12 months, but will be adjusted based on the length of a lease less than 48 months. Vehicles are still eligible even if delivery, freight and other fees (like vehicle colour, add-on accessories, options, and packages) push the actual purchase price over these set limits.

Canada also offers a tax write-off for zero-emission vehicles to support business adoption.

But businesses that receive an incentive from the federal program can’t also use the tax write-off for ZEVs – only one or the other.

China

Current CO2 target

In 2021, China officially submitted its carbon neutrality “before 2060” target. While the update has strengthened and expanded the previous 2030 target, China’s emissions will continue rising, rather than falling, through to 2030.

China also aims to:

- Hit peak carbon dioxide emissions “before 2030”, up from “around 2030 and making efforts to peak earlier”

- Lower carbon dioxide emissions per unit of GDP by “over 65 per cent” in 2030 compared to 2005 levels, (up from “by 60–65 per cent”)

- Increase its share of non-fossil fuels in primary energy consumption to “around 25 per cent” in 2030, (up from “around 20 per cent”)

- Increase forest stock volume by around 6 billion cubic metres in 2030 from the 2005 level, (previously 4.5 billion cubic metres)

- Bring its total installed capacity of wind and solar power to over 1.2 billion kilowatts by 2030.

Previous target

As included above.

Internal combustion engine ban

China as a whole does not have an internal combustion engine ban in the pipeline, however, Hainan island in the South China Sea said in August it will become China’s first region to ban sales of petrol- and diesel-powered cars by 2030.

In 2017 it was widely reported that Beijing was working on a plan to stop making and selling ICE cars, but the Government has yet to release any details.

EV incentives

China began offering EV incentives as long ago as 2009, however expired at the end of 2022 because they were too costly. The EV subsidy scheme was originally scheduled to be phased out by the end of 2020, but Beijing extended it for two years to spur demand in the wake of the COVID pandemic.

At the beginning of 2022, the subsidies for all-electric cars was reduced by 30 per cent from 15,840 CNY to 11,088 CNY.