Consider the powertrain in your car: the engine and related components, such as the transmission, engine cooling and exhaust systems, and emissions control. This complex metallurgical ecosystem adds more value to a vehicle than any of its other systems. It’s made of expensively manufactured parts, many of which are designed to withstand temperatures in excess of 1100 degrees Celsius generated through internal combustion.

But what if you did away with all of that, much as you do in an electric car? You’d assume that the cost of manufacture would probably reduce and, as an important corollary, the amount of man hours required to build the vehicle would be slashed. That has huge implications for car industry jobs.

A study by Ernst and Young estimated that a typical four-cylinder internal-combustion engine (ICE) vehicle has around 2000 components in its powertrain. They looked at the US market and calculated that of the 590,000 employees utilised in parts manufacturing, around 150,000 were employed in building parts for internal-combustion engine powertrains. How are these people going to be gainfully employed when Tesla has stated that its drivetrain has 17 moving parts?

“Should electric powertrains displace those used by gasoline over the next decade and beyond, it is likely that both production and engineering jobs will be affected,” Bill Canis, a vehicle-industry analyst, writes in a May 2019 report to Congress. “Much of the mechanical and materials engineering work undertaken by automobile and parts manufacturers could be replaced by jobs requiring different skill sets such as chemical, battery, and software engineering or by imports of lithium-ion batteries,” he notes.

This puts the USA at a competitive disadvantage as its university curriculums lag behind, still teaching more traditional engineering disciplines. “Few US universities offer degrees in battery engineering, a skill set that is in short supply even today,” Canis says.

The report suggests that Congress should work to create a skills base within the US by utilising the Workforce Innovation and Opportunity Act to retrain the estimated 150,000 workers currently employed making parts for internal-combustion powertrains.

“Workers who today manufacture parts for gasoline or diesel engines could be retrained to make parts for electric vehicle motors and the lithium-ion batteries that power them, although there may be significantly fewer such jobs than exist in automotive supply chains today.”

This mirrors findings in Europe. UBS reported that 58 percent of all German automotive manufacturing employment is dependent on ICE production. It opined that even if lithium-ion batteries were produced within the EU, the impact on employment would be small and certainly wouldn’t compensate for the employment losses described above.

The story gets even worse when looking at tier two suppliers. Traditional car parts suppliers are expected to lose even more of the vehicle content that they currently capture (a loss of around 38 percent) than car manufacturers, which will realise a loss of around 17 percent.

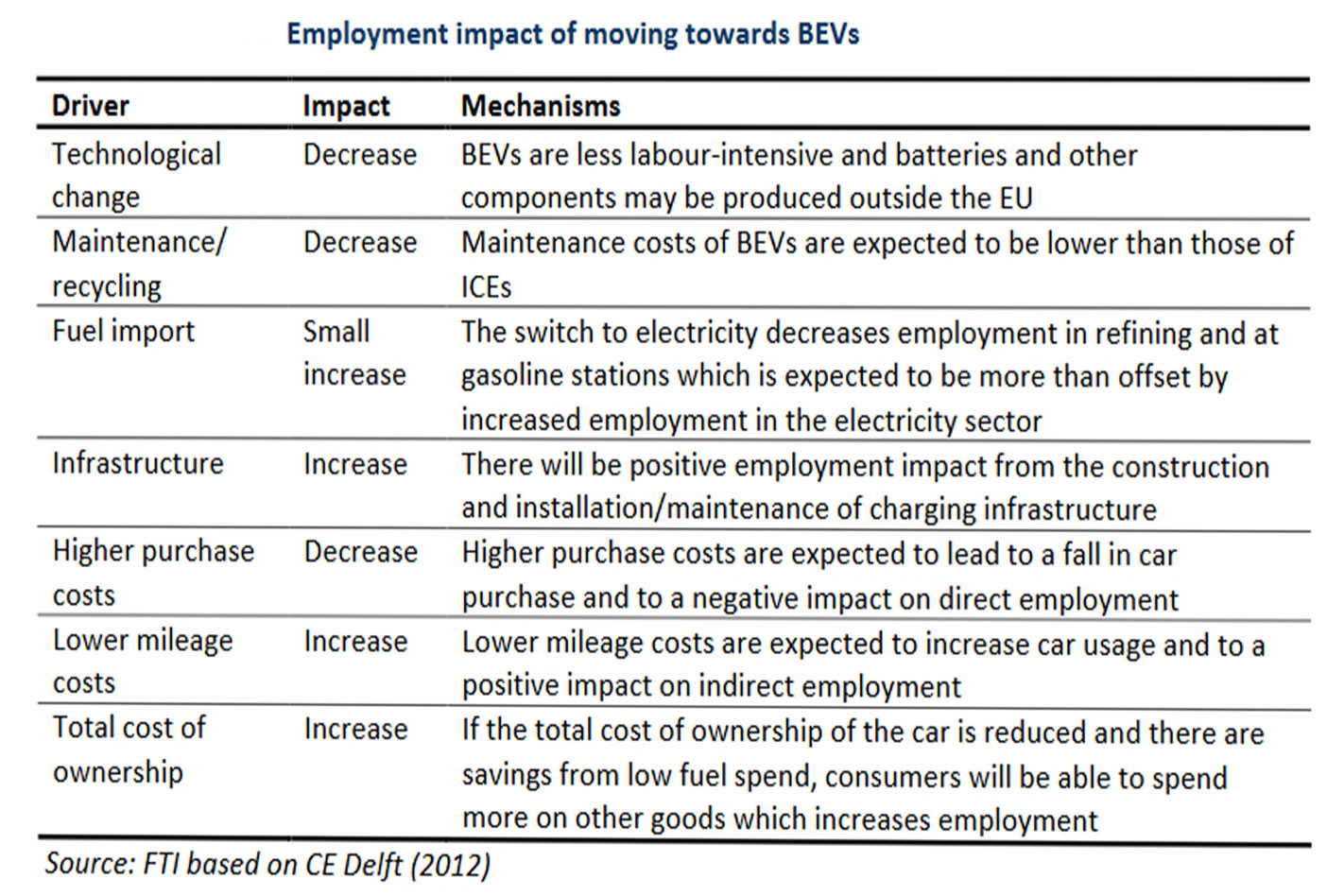

The table above indicates that switching to electric vehicles isn’t all bad news for jobs. Developing the electrical infrastructure, allied benefits in added car use and delivering additional disposable income to drivers all have beneficial effects in the job market.

Here in Australia, we’ve already seen car manufacturers Holden, Ford and Toyota shutter their local plants, so that particular horse has bolted. Where we’re starting to see effects in the job market are the less obvious places.

Sales of automotive fuel in Australia have declined in the past five years from 18,716.8 megalitres in 2011-12, to 18,240.1 megalitres in 2016-17. While this decline is more attributable to increased efficiency of ICE vehicles rather than a huge take-up of EVs, plug-in hybrids are starting to gain a foothold in our domestic market.

The Victorian Automobile Chamber of Commerce believes that the uptake of electric vehicles will progressively reduce the viability of service stations in Victoria. In both the United Kingdom and the United States (US), a direct inverse relationship has been observed between fuel outlet numbers and EV penetration.

The VACC has also worked up a scenario where EV penetration in the state reached 20 percent of new car sales by 2030. Classified as a ‘high-uptake scenario’ by the Chamber, this scenario estimates that 2000 automotive businesses would close and 6000 jobs would be lost as a result. Compare that to the 5000 jobs lost directly from the withdrawal of Ford, Toyota and Holden in 2016/17 and it’s clear that high EV take-up would have significant effects in this particular sector.

At a public hearing in Melbourne, Tim Washington, founder of JET Charge, underscored the opportunities for jobs growth in electric vehicle charging infrastructure. “Globally the charger industry is expected to grow at a compound rate of close to 50 percent from now until 2025 and will reach annual global revenue of A$60 billion,” he said. “In the US alone, EV charging infrastructure has increased by 576 per cent in revenue for the last five years and was expected to go from $27 million in 2011 to $182 million last year, so it is a significant business.”

Washington was bullish about Victoria’s positioning to take advantage of the transition to electric vehicles. “There will be clear winners in this race,” he said. “I think as a Victorian business we have to make a decision: do we want to be part of that circle or do we want to sit back and kind of let the rest of the world dictate what we should and should not take? Doing nothing is definitely an option… But from my perspective, if we choose to do nothing, then we will forever be a technology taker in this space and not a technology provider. Given that this is one of the greatest modal shifts in automotive history, I think it is important for us to provide the technology that sits behind that, and there are Victorian businesses that are doing that right now.”

It’s a given that growth in EVs will reduce traditional manufacturing jobs. As Washington highlights, the challenge will come in reskilling fast in other areas. Australia might not build cars en masse any longer, so it could well be uniquely positioned to capitalise in other areas of infrastructure and development.