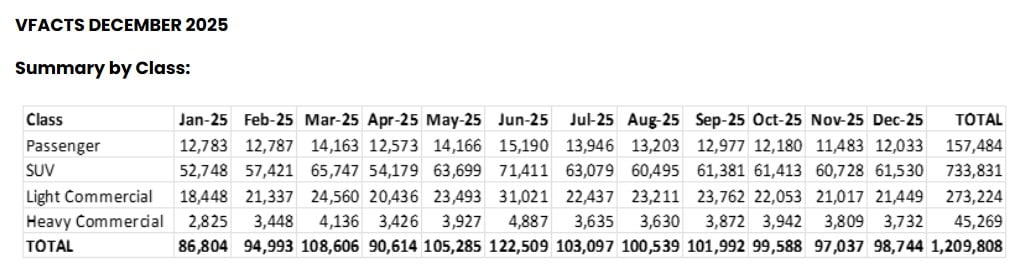

Australia’s automotive market proved resilient in 2025, with total new-vehicle sales reaching 1,209,808 units for the calendar year. While overall volumes eased slightly compared with recent highs, the result reflects sustained consumer demand and a market continuing to evolve as new technologies and vehicle types gain traction.

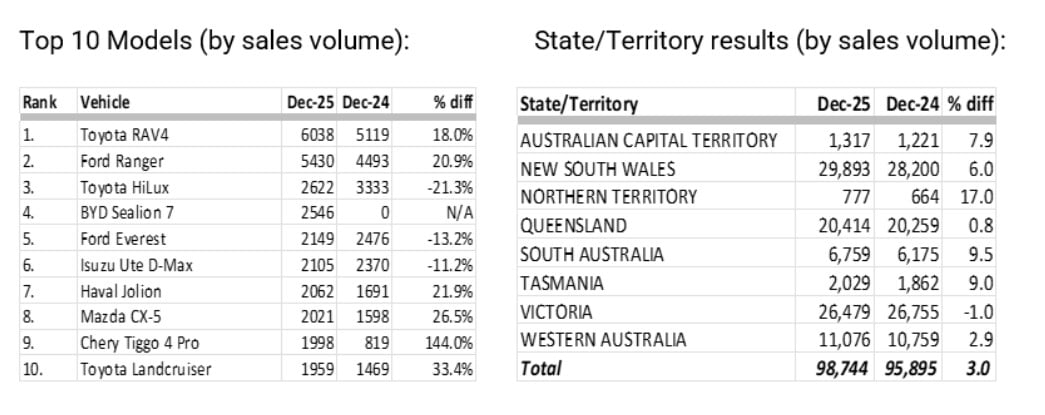

According to Federal Chamber of Automotive Industries (FCAI) chief executive Tony Weber, buyers are responding to an increasingly diverse range of vehicles that cater to family, business and recreational needs. December provided a strong finish to the year, with 98,744 vehicles sold, up three per cent on the same month in 2024.

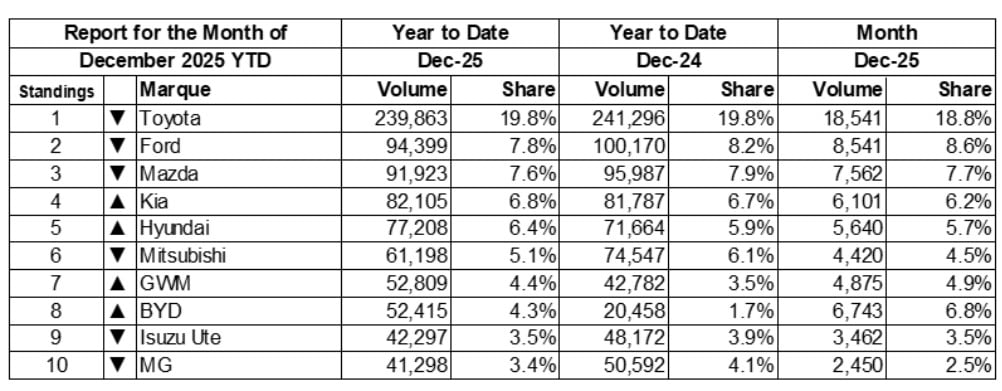

Electrified vehicles were a clear highlight, led by rapid growth in plug-in hybrids. Sales of plug-in hybrid electric vehicles more than doubled in 2025 to 53,484 units, an increase of 130.9 per cent year on year. Conventional hybrids also continued their steady rise, with 199,133 vehicles sold, up 15.3 per cent, cementing their position as Australia’s most popular lower-emissions option.

Battery electric vehicles recorded 103,269 sales from all sources, accounting for 8.3 per cent of the total market. Despite more than 100 EV models now available locally, growth in the segment has been slower than previously forecast. Market share has increased by just 1.1 percentage points over the past two years, prompting ongoing debate about infrastructure readiness and consumer confidence.

The industry also continues to adjust to the New Vehicle Efficiency Standard, which came into effect last year. While early compliance data is yet to be released, the FCAI has warned that future targets will be significantly more demanding and could impact vehicle affordability and choice if not carefully managed.

China further consolidated its position as a major supplier to Australia, with Chinese-built vehicles accounting for about 18 per cent of total sales in 2025, up from around 14 per cent the year prior. Japan remained the largest source country, followed by Thailand, with Korea in fourth place. Together, these four nations supplied roughly 80 per cent of Australia’s new vehicles.

SUVs continued to dominate buyer preferences, representing 60.7 per cent of all sales. Light commercial vehicles followed at 22.6 per cent, while passenger cars fell to just 13.0 per cent of the market. SUV sales rose 5.5 per cent to 733,831 units, while passenger vehicle sales dropped sharply by 22.6 per cent.

Toyota retained its position as market leader, ahead of Ford and Mazda. The Ford Ranger was Australia’s top-selling vehicle, followed closely by the Toyota RAV4 and HiLux, underscoring the nation’s enduring appetite for SUVs and utes.

We recommend

-

News

NewsVFACTS October 2025: Hybrid surge drives new car market

Sales edge up 1.2 per cent as electrified vehicles gain momentum and SUVs continue to dominate showrooms.

-

News

NewsVFACTS August 2025: Vehicle sales hit 100,000 as Chinese brands break into Top 10

BYD, GWM, MG and Chery among Australia’s leading marques, with SUVs maintaining dominance across the market.