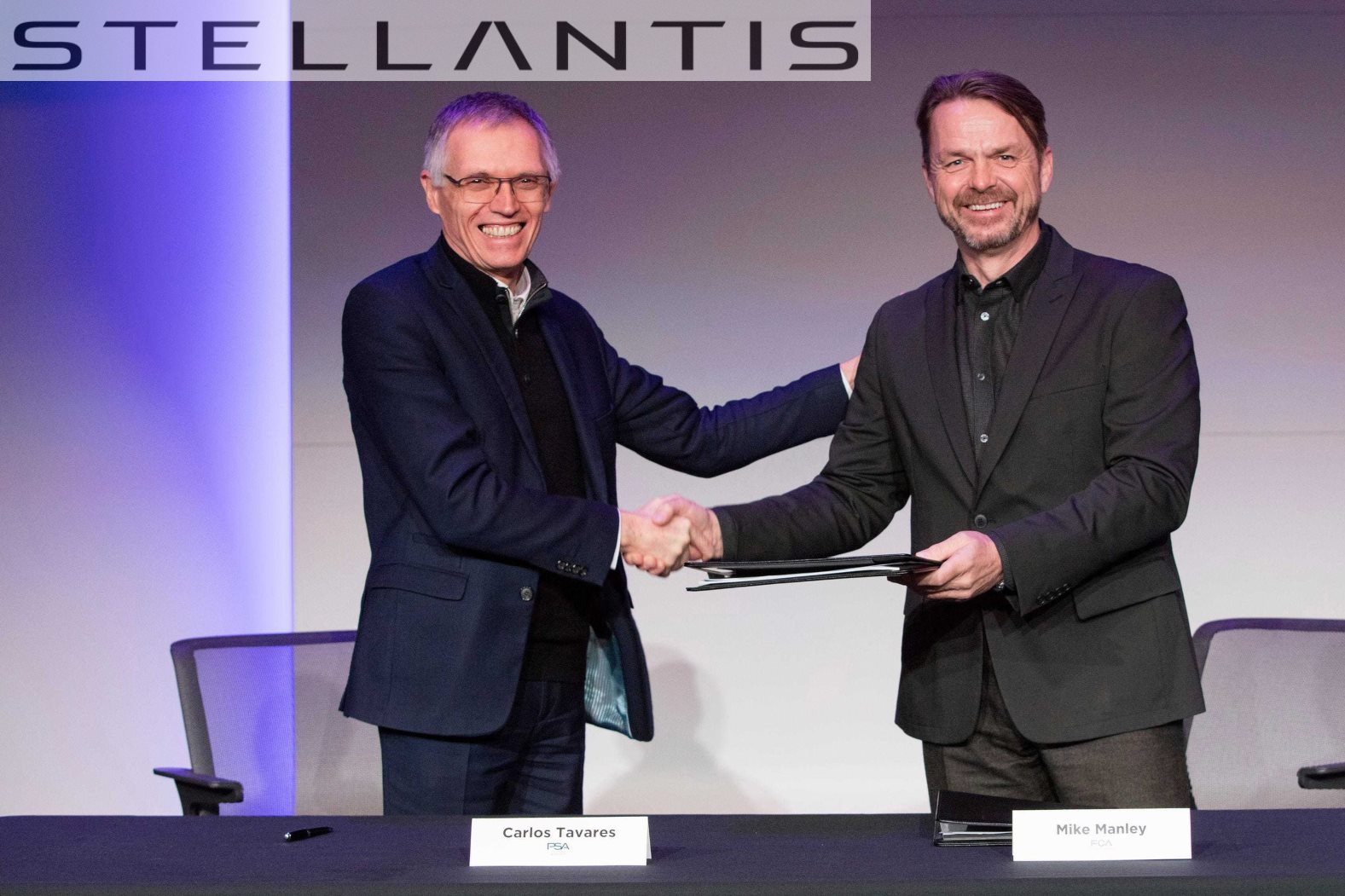

The European Union has approved the merger of Fiat Chrysler Automobiles (FCA) with Groupe PSA, confirming the continent will get a new second biggest automobile maker and the fourth largest on the global stage.

It has obvious implications in Europe where almost every second car sold will be from either the newly formed Stellantis or the reigning champion of European sales, Volkswagen.

When plans to merge were first announced in November 2019, Australian eyes turned to Holden which, following the purchase by PSA of former General Motors brands Vauxhall and Opel, effectively turned the Commodore a different shade of red, white and blue – and could have provided ready access to other PSA products.

A partnership between Holden and PSA – potentially brokered by automotive giant Inchcape – failed to materialise, though, sentencing the iconic brand to the annals of history after GM decided it would be cheaper to dump the brand than to save it.

So what now?

With the formation of the Stellantis group, the brands already sold in Australia – including Abarth, Alfa Romeo, Chrysler, Citroen, Fiat, Jeep and Peugeot – will all effectively be housed under the same roof in the company’s Dutch headquarters.

However, things will continue to look a little different in Australia, where FCA Australia and Peugeot Citroen Australia (PCA) function independently of their HQs in much the same way Audi and Volkswagen have independence, despite joint ownership by parent Volkswagen Group.

Indeed, PSA’s exposure in the Australian market is more closely tied to Subaru than any others, thanks to its Inchcape overseers.

But a number of key brands not currently available in local markets are also subject to the merger, including Dodge, Citroen premium brand DS, Lancia, Opel and Vauxhall.

Not all of these brands are guaranteed to survive the merger – DS and Lancia, in particular – but the introduction of other brands to Australia under the Stellantis umbrella is not out of the question.

With its sales in free-fall prior to its closure, Holden arguably left little vacuum in the market, but an SUV-centric brand offering something fresh and inviting has the potential to lap up some of that spilt milk.

Opel/Vauxhall, for example, currently offer a range of affordable, attractive SUVs that could make a dent here, while the roadmap for new products has already drafted in updated technology from the PSA drawing board – something that GM denied Holden.

Not only will this give future products more scale and lower costs at a production level, it will potentially allow Stellantis to more easily incorporate right-hand-drive architecture into future models.

Could one of the carmakers return to Australia for another skirmish?

Further complexity lies in the final two brands involved in the merge, Maserati and Ram, which are already sold here by independent importers Ateco and GMSV, respectively.

It’s possible the pair will continue on unaffected in the local landscape under a renegotiated agreement, but the more stable Stellantis group may have eyes on one or both of the brands and initiate plans to claim back Maserati and Ram for its own.

In Ram’s case, retrieval is less likely as the operation to convert the models to right-hand drive in Melbourne would need to be replicated, requiring massive investment for a tiny return.

Maserati, however, which already produces its models ready for market, is another matter. A factory distribution of Maserati models is one possible outcome of the FCA/PSA merger.

The most obvious impact on Australian showrooms is likely to be a more widespread platform-sharing plan – exactly what was predicted if the Holden Commodore had made it into a successive generation.

Small Peugeot and Citroen models, such as the Citroen C3, are currently underpinned by a combination of the older PF1 and the more recent EMP1 platform, while larger models such as the Peugeot 308 and 3008 roll on the newer EMP2.

The largest models still use the longstanding PF3 architecture.

While FCA has a number of platforms it could potentially bring to the engineering party, it has already made the decision to share PSA hardware for the basis of its new small and mid-size models.

For example, the electric version of Alfa Romeo’s incoming small SUV, the Tonale, will ride on Peugeot’s eCMP EV platform when it emerges in 2022.

More electrified models arriving in Australia will most likely be the first evidence of the Stellantis takeover.

Speculation aside, the Stellantis deal appears to give PSA the upper hand, giving them access to US markets with the successful Jeep brand at the expense of a host of poorly performing but potentially repairable brand names like Alfa Romeo and Masterati.

How it views its far-flung corners of the empire – particularly those with potentially expensive requirements like right-hand-drive – remains to be seen, but in the short term, at least, nothing much will change for the Stellantis brands currently on sale here in Australia.

Any grand plans for Australia or any other nation for that matter will depend on the newly formed group’s success in its main target market, and all eyes will be on Europe for now.