Figures from leading economists are pointing to a bloodbath in the retail sectors thanks to the ongoing impact of coronavirus in Australia, and the automotive sector won’t be able to escape it.

The car industry itself, meanwhile, is in crisis mode as coronavirus fears and tightening government restrictions around the world force the closure of factories.

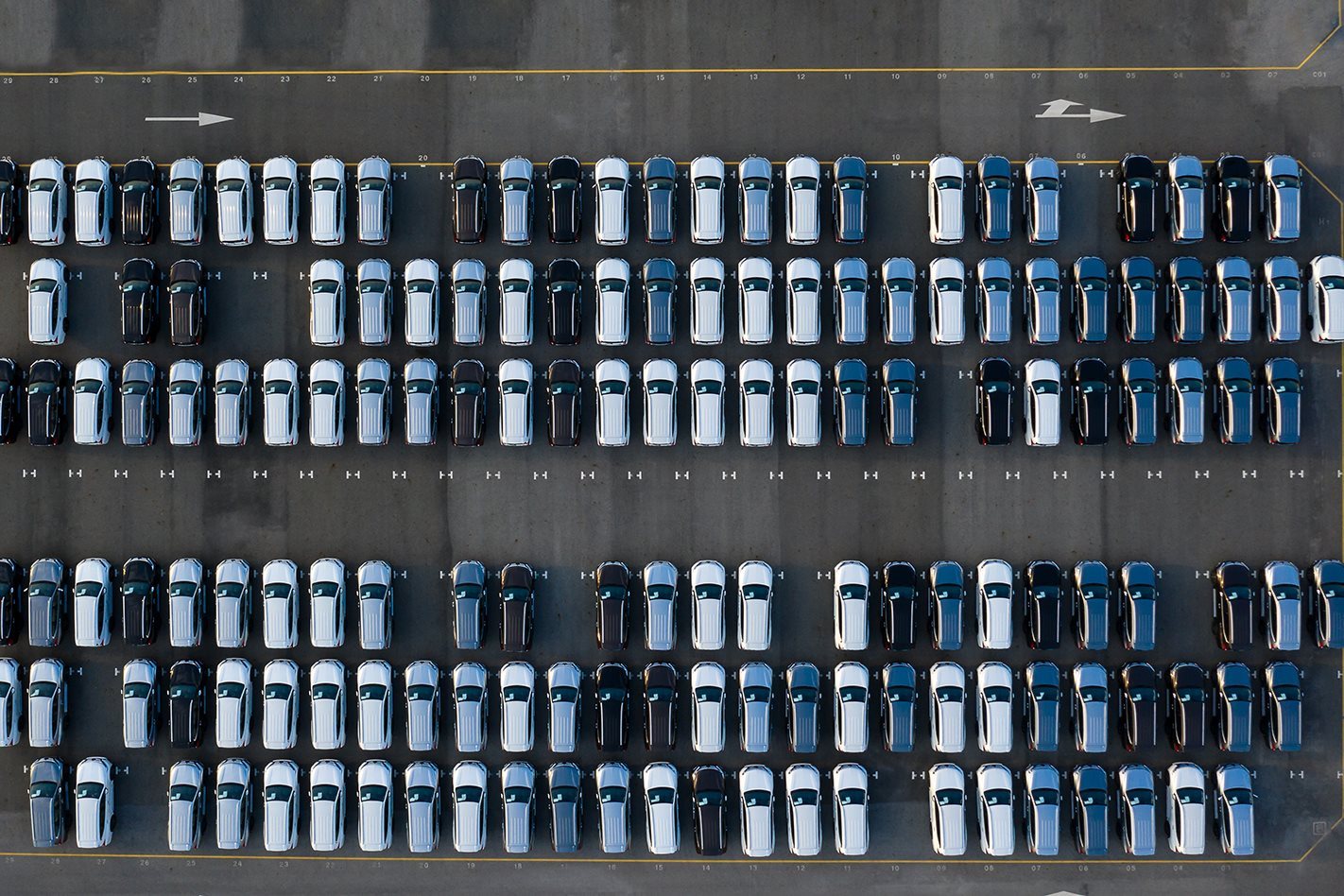

Car sales set to tumble

Leading data analysts at Exante Data are predicting a huge downturn across key sectors of the Australia economy after what it calls a “series of missteps” by the federal government over the last few weeks, taking in the categories of recreation and culture, hotels, cafes and restaurants, and furnishings/household equipment.

It also sees huge downturns in the areas of the purchase and operation of vehicles as well as transport services, which includes taxi and ride-share operators.

“We are looking at a second-quarter GDP [gross domestic product] shock in the range of 20 to 30 per cent on a quarter-to-quarter annualised basis,” says the think tank, who has been tracking economic and other data around the coronavirus pandemic since early January.

If the forecasts are accurate, it means that the already-struggling local car industry will be under even greater pressure than it was coming in off a depressed 2019.

A best-case 20 per cent drop in sales in new cars, for example, means annual figures of new car sales will drop below one million units for the first time since 2009.

The exit of Holden from the Australian market will play a role in the declining figures, but for car makers on the margins, the next few months will be critical.

It’s being reported that Honda, for example, will make an announcement around the reduction of its dealership footprint in Australia later this month in the face of soft sales.

Who will be hurt in car industry shutdown?

Smaller players like Peugeot and Citroen will be under immense pressure as sales all but dry up, while bigger performers like Hyundai will be in head-office battles to maintain supply as its Seoul-based HQ grapples with multiple factory closures, slowdowns and parts shortages across its bigger territories like the US.

A slump in demand for work vehicles like dual-cab utes could affect brands like Ford and Nissan, who both rely heavily on ute sales to underpin poor performers in other categories.

Market leader Toyota is best placed to weather the storm, but history shows that it clamps down hard on discretionary spending and external programs when times are hard, which will likely affect Australian operations.

Why is the coronavirus affecting the car industry?

The effects of the global coronavirus pandemic are being felt in several ways. The most obvious indicator of slow sales is the fact that the community is being asked to practice social distancing, which is limiting people’s ability to physically visit new car showrooms.

As well, the growing concern of a recession hitting the Australian economy is stymieing retail growth across all sectors, with a slight lift in consumer confidence in February (after almost 18 months of decline) being the only glimmer of hope on the horizon for beleaguered business owners.

However, restrictions on travel and social gatherings imposed by the federal government will further erode customer confidence, as people prepare to bunker down ahead of an expected rise in coronavirus cases in Australia in the coming two months.

The practice of social distancing will also impact car-sharing and taxi services, as people opt to either use their own cars for essential trips or simply decide to stay put. More and more businesses – including many car companies – are mandating work-from-home policies that will also impact transport services.

Coronavirus scare cancels Australian Grand Prix

Ride-sharing services may claw some ground back through a rise in demand for food delivery, while the package delivery sector may also be able to weather some of the storm.

Secondary retailers like petrol stations, mechanics and even car parking stations will also feel the bite, as less people move around in their vehicles.

Global car industry grinds to a halt

On an industry side, there are almost more closures and plant idling than can be noted, especially in Europe.

- Mercedes-Benz had suspended production across Europe “The suspension applies to Daimler’s car, van and commercial vehicle plants in Europe and will start this week,” the company said.

- Tesla is unable to operate its main plant in San Francisco, thanks to ‘shelter in place’ provisions that apply to the county that the plant and most of its 10,000 workers reside in.

- Ford‘s plants in Germany, Romania and Spain have been idled for up to three weeks, though its UK plants are still running at the moment.

- Every brand in the Volkswagen Group, including all of VW’s German plants, Lamborghini‘s Sant’Agata plant in Italy, Skoda’s Czech plants and Audi‘s plants in Brussels, Germany and Hungary have been idled.

- PSA Group and Renault have both halted production, with PSA also closing its Opel lines in Germany.

- Toyota has suspended operations in Portugal and the Philippines, though it says its Japanese factories are operating normally.

- Nissan has closed its UK plant in Sunderland – home of the Juke – and is winding back production in Japan due to parts supply shortages.

- FCA has reopened a single light commercial plant in Italy, after reconfiguring it to provide more space between workers. The majority of its plants are closed, including its Ferrari factories in Italy.

It’s set to be a trying time for the automotive sector, but at least it won’t be alone.