The fine print on the company’s site states: “This is the set minimum residual value of your vehicle which is determined up front by your choice of car, finance product, km limit and term”, and the calculator on-site helps you set the parameters.”

Skoda Australia is banking on buyers choosing their in-house finance option – and if they do that, there’s a guaranteed trade-in price waiting at the end of their loan.

The company’s Guaranteed Future Value program is part of a renewed focus to be seen as a value-oriented choice for consumers – particularly now, when every dollar counts.

According to Michael Irmer, Skoda Australia managing director, this offers a big plus for customers who think beyond the attractive drive-away pricing and may be concerned about the resale or residual value.

“This is a relatively new concept to the Australian market; it has maybe gone through exactly one buyer cycle so far. We at Skoda, we’re having 20 percent take-up,” Irmer said.

“You might be thinking ‘that’s not much’, but it’s actually quite good, more than most other players. But is there more potential? Absolutely.”

The brand’s boss said in Australia and other markets, about 70 to 80 percent of new-car customers are seeking finance in one form or another, be it drawing from a mortgage or offset account, getting a loan from family, or taking out a car loan or personal loan from a bank.

Car dealership financing, Irmer said, perhaps isn’t considered as solid an option, given some unscrupulous dealings by OEM financial services businesses in the past.

“Car dealership financing is only getting a portion of this in Australia at the moment – it has to do with some of the history and the legacy of that industry, which was largely unregulated until recently,” he said.

“Regulation has improved, but there’s a lot of damage done to the perceptions. It’s not the first port of call to go to the car dealership for buying finance, because they’ve been exposed to a lot of bigotry and negative surprises – balloons set too high, so that you’re in negative equity. Things like that. Or no guarantee for your residual value. Or [varied percentage] rates for risk assessment.”

Mr Irmer said ambiguity in the terms and conditions of some loans was something Skoda Australia had aimed to negate with its clear and simple plans.

“We want to take that all away with this program. In the UK, for instance, roughly 70-80 percent of buyers buy with this program. But in Australia we come from a different starting point, so it will not get to that high level anytime quickly, but we want to evolve it further.”

Skoda will soon launch its first EV model in Australia – the Enyaq SUV – which will be the most expensive Skoda ever. But, as has been evidenced in some other cases, the Enyaq could see a better residual value as a result of the ‘early adopter’ EV phase having passed.

Mr Irmer said the brand understands the level of uncertainty in buyer’s minds when it comes to EV resale values.

“Where it becomes really important is with electric cars,” he said. “There’s one thing that is unique [compared] to the ICE cars – the purchase price is a bit higher, but it comes with lower running costs.

“But for a consumer, there are two other things which are really important. One is, how is it going to be with selling the car in a couple of years – especially when you see the news coming from the UK, the Americas or from Europe, people are a little bit fearful [of EV resale values].

“What is it going to be, how is it going to be with the battery and the quick advances in technology?” he pondered.

“So then it is a really good thing to have such an asset [as GFV], and such reassurance that somebody taking the leap going into a BEV at least being protected from any surprises there. It’s even more important than in the ICE vehicles.

“Technology advances, and battery [improvements] are much faster at the moment. And that means it maybe also makes sense for many consumers to say ‘I want to be ready to transition maybe in four or five years’, and with the GFV program you can really easily do it,” said Mr Irmer.

The Skoda Enyaq EV range will launch in October 2024, with the standard Enyaq ‘85’ with a single-motor layout and the dual-motor AWD Enyaq RS hitting the road then. Pricing for both is still to be confirmed, but both will come highly specified, and at launch, each will solely be offered in the Coupe-style body design.

The ute market as we know it: The Ranger and Hilux have a stranglehold on the top two sales spots, a bunch of other utes sell in huge numbers, and dual-cabs are everywhere from mines to school runs.

More are on the way, too, like the Kia Tasman and the GWM Cannon Alpha and BYD’s plug-in hybrid ute. So the manufacturers, at least, believe the market isn’t saturated yet.

Why not imagine some more, then?

To kick off a compact ute market in Australia, our mate Theottle has imagined a Suzuki-badged entry into this crowded category – a kind of ‘Gladiator Junior’ based on the loveable Jimny.

The Gladiator is a bit much sometimes, based as it is on the hardcore Wrangler. So Theottle’s renders show how a smaller, more manageable, Gladiator-style dual-cab based on the Jimny could be designed.

Theo’s most obvious tweak is the addition of a tray back, comprised of all new sheet metal, which looks to be in the order of a metre or so long. Jimnys have the entire tail light modules mounted in the rear bumper, meaning that Theottle’s chosen design would also have to be developed from scratch.

Moving forward, not only is all sheet metal to the rear of the doors new, but the rear doors are also revised, thanks to the rear wheels moving back to extend the wheelbase and keep the rear overhang in check.

The Jimny’s rear quarter lights have been removed and a solid near-vertical c-pillar features, channelling Land Cruiser 70-Series utes.

Everything forward of the B-pillar is unchanged from the Jimny wagons. Theottle’s ute revises quite a lot of the Jimny wagon’s body-in-white and delivers a visually balanced design.

Would you be interested in a Jimny Dual Cab?

Let us know in the comments below.

The GWM Ora now starts at $35,990 driveaway with new national pricing making it the most affordable electric vehicle in Australian showrooms.

Previously priced at $39,990 before on-road costs, the new pricing sees the Ora take the title of Australia’s Cheapest EV from the BYD Dolphin, which is priced from $38,990.

Temporary run-out offers in late 2023, and up to the end of March 2024, had practically made the Chinese-built Ora the cheapest EV in the country, but the new national driveway price makes it the country’s most affordable even without any discounts.

The Ora and Dolphin have been competing with the MG4 for the eponymous title as Australia’s cheapest EV, with the BYD Dolphin priced at $38,890 a mere $100 cheaper than the MG4 it took the ‘cheapest’ mantle from in late 2023.

The MG4 starts from $39,990 drive-away.

In a statement GWM Australia said favourable exchange rates had helped its sharpen the Ora’s pricing.

The $35,990 driveway price for the Standard Range Ora – offering a 320km range from a 126kW/250Nm motor and 48kWH lithium-ion battery – comes with revised driveway pricing range-wide from GWM’s 95-dealer network.

The GWM Ora Extended Range is now $40,990 driveway, previously $45,990 plus on-road costs, and brings a larger 63kWh battery pack and 420km claimed range.

Above: BYD Dolphin

The higher-spec Ora Ultra Extended Range is $43,990 – down from $44,990 before on-roads – while the is flagship Ora Ultra GT $46,990, down from $51,990 before on-roads. All GWM Ora models are equipped with keyless entry, Apple CarPlay smartphone compatibility and a 10.25-inch centre display.

The news comes days after Tesla – which dominates the Australian electric vehicle market – announced price reductions of up to $8500 for the updated Tesla Model Y SUV arriving in showrooms in June 2024.

The Tesla Model Y was the best-selling electric car in Australia in 2023. https://www.whichcar.com.au/news/2024-tesla-model-y-pricing-features-

The 2024 GWM Haval Jolion small SUV appears in line to receive a facelift soon.

Official documents submitted by China’s GWM to the Federal Government’s new-vehicle approval database list two new Haval Jolion variants, known as the ‘A01 FL [facelift]’ with a different look to the current model.

The facelifted Haval Jolion is expected to be followed by another small SUV in GWM-Haval’s local line-up, the heavily-related Jolion Pro – also known as the ‘Chitu’ in its Chinese domestic market.

Similar to its MG ZS and ZST rivals, the Jolion Pro should replace current flagship versions of the Jolion, while the existing car will continue with a facelift for lower-cost variants.

The government approval documents list two variants of the facelifted Jolion, both featuring 17-inch alloy wheels and a 110kW/220Nm 1.5-litre turbo-petrol four-cylinder, matched to a seven-speed dual-clutch automatic transmission and front-wheel drive.

Styling changes for the facelifted Jolion include a new-look grille, revised front and rear bumpers, redesigned alloy wheels, grey side mirror caps, revised tail-light internals, and a ‘G-W-M’ tailgate badge in place of the existing ‘H-A-V-A-L’ logo.

It is unclear if GWM has updated the Haval Jolion’s interior for the facelift.

The facelifted 2024 GWM Haval Jolion will likely continue to be offered in Premium, Lux and Ultra variants in Australia, while the Jolion Pro could replace current S, Lux Hybrid and Ultra Hybrid models.

Like the current Jolion S and Hybrid, the Pro features multi-link independent rear suspension instead of the torsion-beam fitted to standard models.

Measuring 4470mm long, 1898mm wide and 1625mm tall, with a 2700mm wheelbase, the Jolion Pro is 2mm shorter, 57mm wider and 51mm taller than the Jolion, with an unchanged wheelbase.

In China, the Haval Jolion – which means ‘first love’ in Mandarin – replaced the Haval H2, while the Chitu/Jolion Pro is the successor to the Haval F5. Both models are based on GWM’s ‘LEMON’ platform.

Only the Chitu is still available in China as the Jolion became an export-focused model in 2021.

The facelifted 2024 GWM Haval Jolion and the related 2024 GWM Haval Jolion Pro are expected to arrive in Australia soon. Stay tuned to Wheels for the latest information.

Below: The current GWM Haval Jolion

Australia’s new car market has set another record month in March 2024 with the result cementing a new all-time benchmark for the first quarter of a calendar year.

Toyota finished up as March’s best selling brand while the Ford Ranger remained the best-selling nameplate.

March 2024 saw 109,647 new vehicle registrations, a jump of 12.7 per cent – 12,396 sales – compared to March 2023 when 97,251 vehicles were sold.

March’s record combined with January and February results sees a benchmark first quarter for new vehicle sales of 304,452 – an increase of 13.2 per cent over Q1 2023.

Almost every segment increases year-on-year in March, with the total passenger vehicle market up 426 units (2.5 per cent) led by a 20.7 per cent rise (11,105) in SUV sales.

The Light Commercial market – in the wake of controversial emissions laws from the Federal Government – increased 4.8 per cent (1049 vehicles) while the heavy market was the only area of decline, with a 4.1 per cent drop representing 187 vehicles.

Electric car sales cracked 10,000 units for the first time led by the Tesla Model Y.

Australia’s top 10 cars for March 2024

The Ford Ranger continued its reign at the top of the sales charts with 5661 sales, which is up 1153 units year-on-year (+25.6 per cent).

The Toyota RAV4 took the runner-up spot with 5070 sales – up from 1778 in March 2023 to post a 185.2 per cent increase, the greatest for the month.

The Tesla Model Y was the most popular electric vehicle and third overall with 4379 sales – more than double its March 2023 result of 1938 sales (+126 per cent).

The Ford Ranger’s arch rival, the Toyota HiLux, held the number one spot 12 months ago but fell to fourth in March 2024 with 3995 sales, a drop of 12.8 per cent on its March 2023 result.

It was one of only two cars to decline year-on-year, the other being the Isuzu D-Max with its 2465 sales less than the 2789 sold last March. The D-Max was beaten to fifth place by the Mitsubishi Outlander (2764).

Seventh was the Ford Everest (2264) ahead of the Nissan X-Trail (2161), Toyota LandCruiser (2159) and Mazda CX-5 to complete the 10-best sellers.

Australia’s top 10 car brands for March 2024

Toyota was the best-selling brand with 18,961 sales for the month and a staggering 18.5 per cent total market share, up 37.4 per cent year-on-year and well ahead of Ford in second place.

Ford’s 8776 sales for March – with the Ford Ranger making up 5661 of that figure – was enough to take second position for the month ahead of Mazda which recorded 8246 sales (down 6.1 per cent over March 2023).

Despite being the only top 10 car maker to post a fall in sales year-to-date, Mazda is still ahead of Ford for the year so far, maintaining second place overall with 23,761 sales to Ford’s 22,657 (+18.5 per cent).

Mitsubishi was fourth – replicating the top four order from last month – with 7866 sales (+21.3 per cent), with Kia (7070, +2.8 per cent) pushing Tesla to sixth (6017, +22.9 per cent) and Hyundai to seventh (5985, +23.5 per cent).

Nissan (4976, +69.6 per cent), Isuzu (4351,+23.5 per cent) and MG (3948. +0.4 per cent) filled out the top 10 for March.

New South Wales registered the most vehicles with 33,808 sales, ahead of Victoria and Queensland with 30,099 and 23,550 sales, respectively.

Western Australia (11,074), South Australia (6992), Tasmania (1610), the ACT (1584), and the Northern Territory (930) followed.

“This is a terrific result for the sector however, all car brands are well aware that these results cannot be taken for granted,” said FCAI (Federal Chamber of Automotive Industries ) Chief Executive, Tony Weber.

“We need to factor in the ongoing cost of living pressures and the challenges for industry and consumers that will emerge with the introduction of the New Vehicle Efficiency Standard (NVES) in less than nine months.”

Tesla will not be accounted for from July 2024 given the brand’s decision to quit the Federal Chamber of Automotive Industries (FCAI) following the organisations stance on the Australian federal governments emissions laws.

Sales of battery electric vehicles increased 46.4 per cent year-on-year to 10,464 sales (up from 6612 in March 2023) led by the Tesla Model Y to make up 9.6 per cent of all sales. That’s up from the 7.2 per cent share for the full 2023 calendar year and 6.5 per cent at the end of March 2023.

Non-plug-in hybrid sales were up 118.6 per cent year-on-year to 13,935 with plug-in hybrid sales increasing to 1412 from 569.

? Australia’s top 10 cars for March 2024

Ups and downs ? ?

| Rank | Model | Sales 2024 | Sales 2023 | % diff |

|---|---|---|---|---|

| 1 | Ford Ranger | 5661 | 4508 | 25.6% |

| 2 | Toyota RAV4 | 5070 | 1778 | 185.2% |

| 3 | Tesla Model Y | 4379 | 1938 | 126.0% |

| 4 | Toyota HiLux | 3995 | 4583 | -12.8% |

| 5 | Mitsubishi Outlander | 2764 | 2169 | 27.4% |

| 6 | Isuzu Ute D-Max | 2465 | 2789 | -11.6% |

| 7 | Ford Everest | 2264 | 985 | 129.8% |

| 8 | Nissan X-Trail | 2161 | 963 | 124.4% |

| 9 | Toyota Landcruiser | 2159 | 1683 | 28.3% |

| 10 | Mazda CX-5 | 2134 | 1917 | 11.3% |

? Australia’s top 10 car brands for March 2024 (YTD)

Ups and downs ? ?

| Rank | Make | Mar-24 | Mar-23 | % diff |

|---|---|---|---|---|

| 1 | Toyota | 56,238 | 40,918 | 37% |

| 2 | Mazda | 23,761 | 25,317 | -6% |

| 3 | Ford | 22,675 | 19,131 | 19% |

| 4 | Mitsubishi | 20,188 | 16,639 | 21% |

| 5 | Kia | 18,918 | 18,409 | 3% |

| 6 | Hyundai | 17,850 | 16,682 | 7% |

| 7 | Nissan | 14,293 | 8,425 | 70% |

| 8 | Isuzu Ute | 12,801 | 10,361 | 24% |

| 9 | Tesla | 12,789 | 10,407 | 23% |

| 10 | MG | 12,429 | 12,385 | 0% |

In charts ?

March 2024 – Top 20 models

March 2024 – Top 10 brands

March 2024 – Overall segment sales

March 2024 – Category sales

March 2024 – Sales map

March 2024 – Buyer type

March 2024 – Sales race

APRIL 4: Zeekr has been confirmed for Australia

Chinese brand Zeekr has confirmed it’s coming to Australia in 2025. We’ve updated this story to reflect the latest news.

——-

Australia is set to break the all-time new vehicle sales in 2023, as more than 1.1 million new vehicles have been registered so far this year.

Notably, battery electric vehicle (EV) sales have seen a huge increase with 80,446 delivered so far this year, marking a significant boost over the same period in 2023, at just 28,326 – proving the growing interest in low-emission vehicles among Australian consumers.

It’s easy to see the opportunity here in Australia for brands offering electrified models, and a few are jumping onto our humble island to offer more choice than ever before. (And steal a piece of that sales pie.)

In recent years, brands like MG, Chery and BYD have jumped into the mix with a range of electrified options, and while these value-focused cars are proving popular with Aussies, they’re only a drop in the ocean of opportunity.

Let’s take a look at some Chinese brands that may come along for the ride sometime soon.

Xiaomi

Xiaomi Automotive, a division of the well-known Chinese electronics company Xiaomi, is making a strategic entry into the EV market.

Announced in 2021, Xiaomi Automotive signifies an expansion beyond consumer electronics, reflecting the company’s ambition to become a key player in the rapidly growing EV sector.

The Xiaomi SU7 has been spotted in China recently wearing camouflage. Although the naming convention is a little confusing, the EV is an aerodynamic and sporty looking four-door coupe, which some have called a “Taycan for young people”.

Leapmotor

Leapmotor, an EV manufacturer established in 2015, is making waves in China’s automotive industry with its focus on sustainable and intelligent EVs.

Based in Hangzhou, China, Leapmotor says it aims to offer affordable, high-quality electric vehicles equipped with advanced technology, including autonomous driving and efficient energy systems.

The company’s proprietary battery technology and software enhance vehicle performance and safety. Leapmotor’s product range caters to various consumer needs, from compact city cars to spacious family vehicles.

Stellantis (think Jeep, Fiat and Peugeot) recently acquired approximately 20% of Leapmotor for 1.5 billion euros. The deal also highlighted the venture of Leapmotor International that gives the brand exclusive rights to sell Leapmotor products outside of China.

Deepal

Deepal operates as an EV brand under Changan, which is recognized as the oldest automaker in China and the smallest among the ‘big four’ state-owned automobile companies.

According to CarNewsChina, Deepal’s CEO says the brand will aim to sell 450,000 EVs in 2024. This target was set to coincide with their expansion into European and ASEAN markets.

Two of its new models, the SL03i sedan and S7i SUV, launched only a few months ago. These models feature a valet autonomous parking system, allowing the vehicle to recall a previously taken parking route. Once a driver returns to a familiar parking area, this system can autonomously park the vehicle in the memorised spot, even in multi-level garages.

The system also includes enhanced features like in-car and remote parking assist, and can autonomously move the vehicle to another spot when the parking time limit is reached.

Zeekr

Since publishing this piece, Zeekr has confirmed plans to launch in Australia in 2025 with a luxury people mover and small SUV.

Launched in 2021, Zeekr is a premium electric vehicle brand operating globally under the Geely Group umbrella. If that sounds familiar to you it’s likely because Geely also owns Volvo and its electric counterpart, Polestar.

The brand has three models for sale globally, two of which will land down under soon.

First will be the Zeekr 009, a spacious family vehicle available in six- or seven-seat configurations, boasting impressive performance and a driving range of up to 800 kilometres.

Additionally, Zeekr plans to introduce a compact SUV, the Zeekr X, positioned as a competitor to the BMW iX1.

Neta

Neta, a brand of Hozon Auto, is another emerging EV maker, gaining recognition in the competitive EV market.

Launched in 2018 and headquartered in Zhejiang, China, Neta focuses on producing affordable and accessible EVs, aiming to make sustainable transportation widely available.

But it’s the international expansion where Neta wants to shine, as it’s building a plant in Thailand to make right-hand-drive vehicles.

In October, Neta announced its entry to the Middle East, and this month the company disclosed it will sell vehicles in the Latin American market, starting with Costa Rica, with the intention to launch in Europe soon after.

Ivan Pavlov conducted experiments with dogs to explore how they learn. He discovered that by ringing a bell every time he fed them, the dogs would start to salivate just from hearing the bell, even without food present.

This demonstrated how animals (and humans) can learn to associate two unrelated things—like a bell sound with food expectation—a process known as classical conditioning.

A similar, albeit more frustrating kind of conditioning seems to happen between Hyundai Group’s latest vehicles and myself, where their attempts to alert me with chimes that I’m over the speed limit result in me yelling “I’m not bloody speeding!”, whilst alone in the car.

The first encounter with this chime, in the Hyundai Palisade, made me so irate that I started to avoid driving when I could. Those were a particularly fit couple of days when I walked to the supermarket. The tone coming from the car was pretty loud and incessantly repetitive. And it’s not just Hyundai; these auditory alerts have become almost an industry standard.

With ANCAP’s increasing safety standards each year, car manufacturers are pushed to enhance active safety features

The problem is that these alerts sound for so many different reasons reasons: speeding, entering a new speed zone, detecting a car in your blind spot, a cyclist nearby, parking assistance, unfastened seatbelts, keys left in the car, an open door, left-on headlights or engine, and sometimes, seemingly for no reason at all. Perhaps these are just preemptive alerts for future, actual alerts?

With ANCAP’s increasing safety standards each year, car manufacturers are pushed to enhance active safety features to maintain top ratings. However, one could argue there must be a better method than bombarding drivers with 75 different audio alerts.

Recently, popular models like the Hyundai Kona and Genesis GV70 have introduced a speed alert feature that dings and flashes the speed limit on your heads up display.

While meant to help drivers adhere to speed limits and avoid fines, I find this feature often ends up being more annoying than helpful.

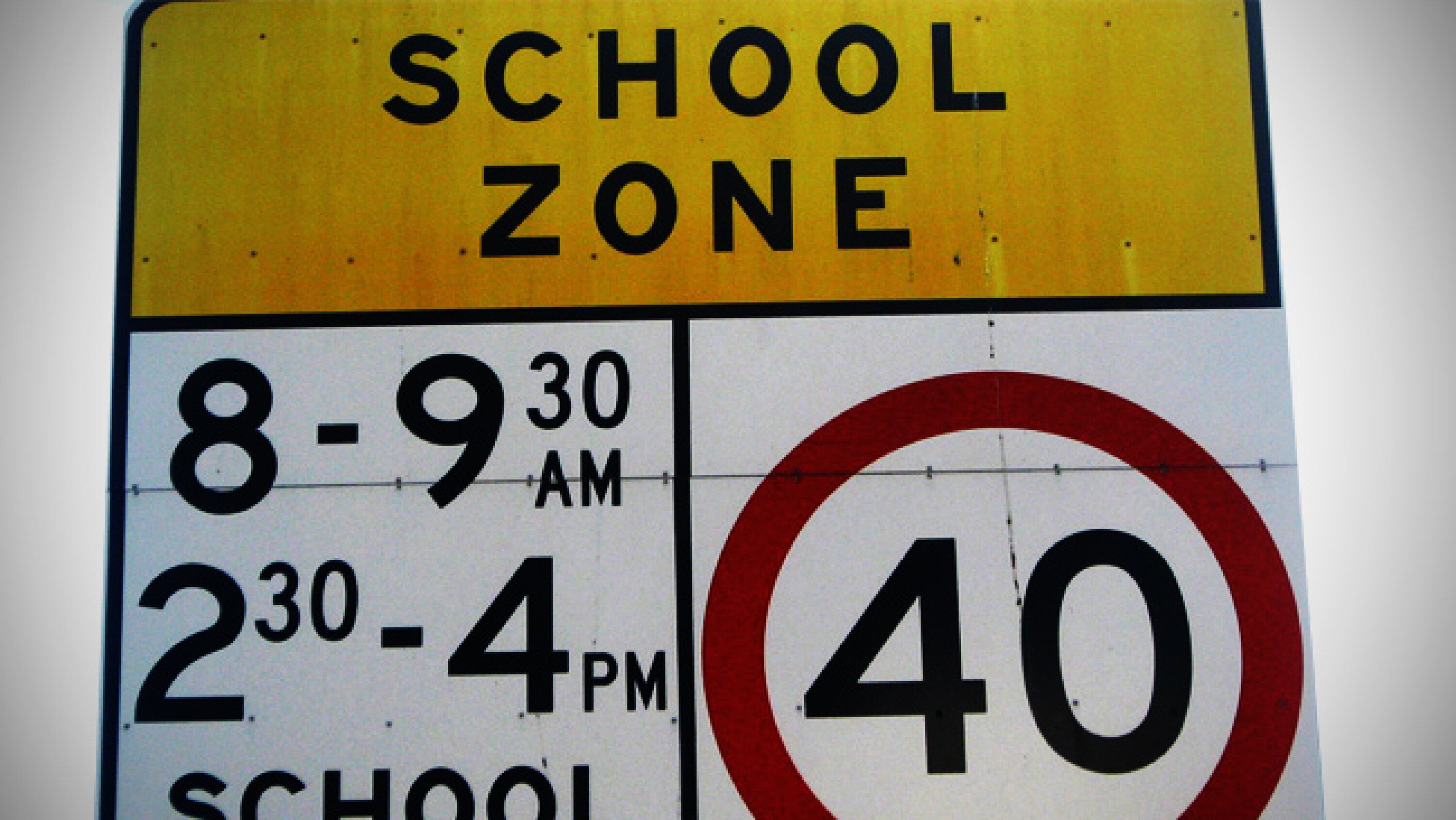

One issue is that the road sign recognition technology can only identify speed limit signs without understanding the contextual conditions, like time-specific school zones. This can lead to incessant and misleading chimes as the car inaccurately thinks you’re speeding.

This situation mirrors Pavlov’s experiment: if the conditioned stimulus (the bell, or in this case, the beep) continues without the expected outcome (food, or the actual need for an alert), the subject begins to ignore the stimulus. Similarly, drivers start to disregard these beeps and dings after repeated false alarms.

Although this technology can be deactivated, it resets with every engine start, presenting no permanent solution to the frustration.

In the past, innovations like the Holden Equinox’s haptic feedback seats attempted to replace audio alerts with vibrations when parking the car. So the closer you got to a wall, the stronger the buzz. I think the theory was rock solid but in practice I won’t lie, it was pretty strange.

Safety in cars is crucial, and drivers value the assurance that they, their loved ones and surrounding people are protected. However, the constant barrage of beeping from safety reminders can undermine this peace of mind.

Many drivers, especially those transitioning from older to newer vehicles, find the plethora of alarms overwhelming– myself included.

While these tones aim to keep drivers alert, they often serve more as a distraction than a helpful alert system.

The question then becomes: are we being conditioned to stay focused, or are these sounds simply turning into a symphony of distractions?

Set to launch here in June, the Kia EV5 medium SUV will be the brand’s most affordable EV yet, with prices likely starting “in the 50s” according to Kia Australia boss Damien Meredith.

Given an entry point in the $50K bracket, the base Kia EV5 electric SUV would appear to offer tremendous value compared to its entry-level rivals – the Tesla Model Y ($65,400), Toyota bZ4X ($66,000), Subaru Solterra AWD ($69,990) and Ford Mustang Mach-E ($72,990), not to mention Kia’s own EV6 Air ($72,590).

https://www.facebook.com/WheelsAustralia/videos/1684332665639858/

“We’re pretty confident we can get a really, really, really, really good price,” said Mr Meredith regarding the EV5’s price positioning. “So we think we can probably get in the 50s [for the EV5 Air] – that’s our target.”

To be offered in three variants (Air, Earth and GT-Line) in both standard- and long-range forms, the entry-level EV5 Air will feature a single electric motor, front-wheel drive and a 64.2kWh lithium-ion phosphate (LFP) battery sourced from China’s BYD for better fast-charge capability and ease in charging to 100 percent, without degrading the battery over time.

Producing an expected 160kW/310Nm, the front-drive EV5 Air should be good for 0-100km/h in 8.5sec, a claimed NEDC range of 490km (more accurate WLTP figures are yet to be released) and 102kW maximum DC charging speed.

The official charging data quoted for this powertrain in Thailand (which also sources its EV5s from Kia’s Chinese production facility) states 10-80 percent in 36 minutes.

The long-range EV5 will also be front-wheel drive, featuring the same 160kW/310Nm front-mounted electric motor but a larger 88.1kWh LFP battery for 36 percent more range (665km NEDC), though a marginally slower 8.9sec 0-100km/h time.

It features a 141kW maximum DC charging speed and can go from 10-80 percent in 38 minutes.

The dual-motor EV5 AWD – expected to be offered only in flagship GT-Line form, and not arriving here until the fourth quarter of 2024 – adds a 70kW/170Nm electric motor to the rear axle for combined outputs of 230kW and 480Nm.

This lowers the EV5’s claimed 0-100km/h time to a brisk 6.1sec without impacting too much on its NEDC range (620km), or its charging speed compared to the 88.1kWh long-range.

Benchmarked against the Tesla Model Y and Volkswagen ID.4 (due in Australia around July/August this year), the EV5 medium SUV is intended to be a more comfort-biased, pragmatic alternative to the sportier, coupe-shaped EV6 liftback – giving Kia the advantage of two distinct mid-sized EV models, rather than simply two bodystyles.

Based on a development of Hyundai-Kia’s existing E-GMP bespoke electric-vehicle platform (dubbed N3 eK), the Chinese-manufactured EV5 features modularised front and rear chassis components that are different to E-GMP models, as well as more cost-effective 400-volt electrical architecture to make the EV5 less expensive to produce.

Measuring 4615mm long, 1875mm wide and 1715mm tall, riding on a 2750mm wheelbase, the EV5 sits smack-bang in the heart of medium SUV territory.

In comparison, the forthcoming Volkswagen ID.4 electric SUV (which is rear-wheel drive in its base form) stands 4584mm long, 1852mm wide and 1636mm tall, riding on a 2765mm wheelbase.

Kia’s existing EV6 – launched in Australia in February ’22 but with a mid-life facelift due later this year – is similar in length (4680-4695mm) and width (1880-1890mm) to an EV5 but is much lower (1550mm) and rides on a significantly longer wheelbase (2900mm) for a dramatic difference in its visual proportion.

Kia Australia says the five-seat EV5 is very much an SUV whereas the EV6 is more of a regular passenger car – “the EV6 remains very much a driver’s car and feels more like a Stinger successor than it does an SUV, despite FCAI’s categorisation,” said Roland Rivero, Kia’s general manager product planning.

This puts Kia in an enviable marketing position with its mid-sized offerings – the new Sportage GT-Line Hybrid flagship ($55,420) being similarly priced to an entry-level EV5 Air, and the top-spec EV5 GT-Line AWD likely to be priced in the vicinity of the entry-level EV6 Air ($73K), meaning a progressive line-up of complementary products.

Indeed, according to Dean Norbiato, Kia Australia’s General Manager Marketing: “Karim Habib, who is head of global design, very much sees the EV9 as setting the family look and feel that’ll extend through EV5 and then EV3 [a compact electric SUV].

He doesn’t want them to be brother and sister – he wants them to be cousins, [so] they have their own identity, but it is very much an SUV-first look.”

Following hot on the heels of the Car of the Year-winning EV6 (2022) and the game-changing seven-seat EV9 (2023), the all-new Kia EV5 is an entirely different taste of electric vehicle architecture.

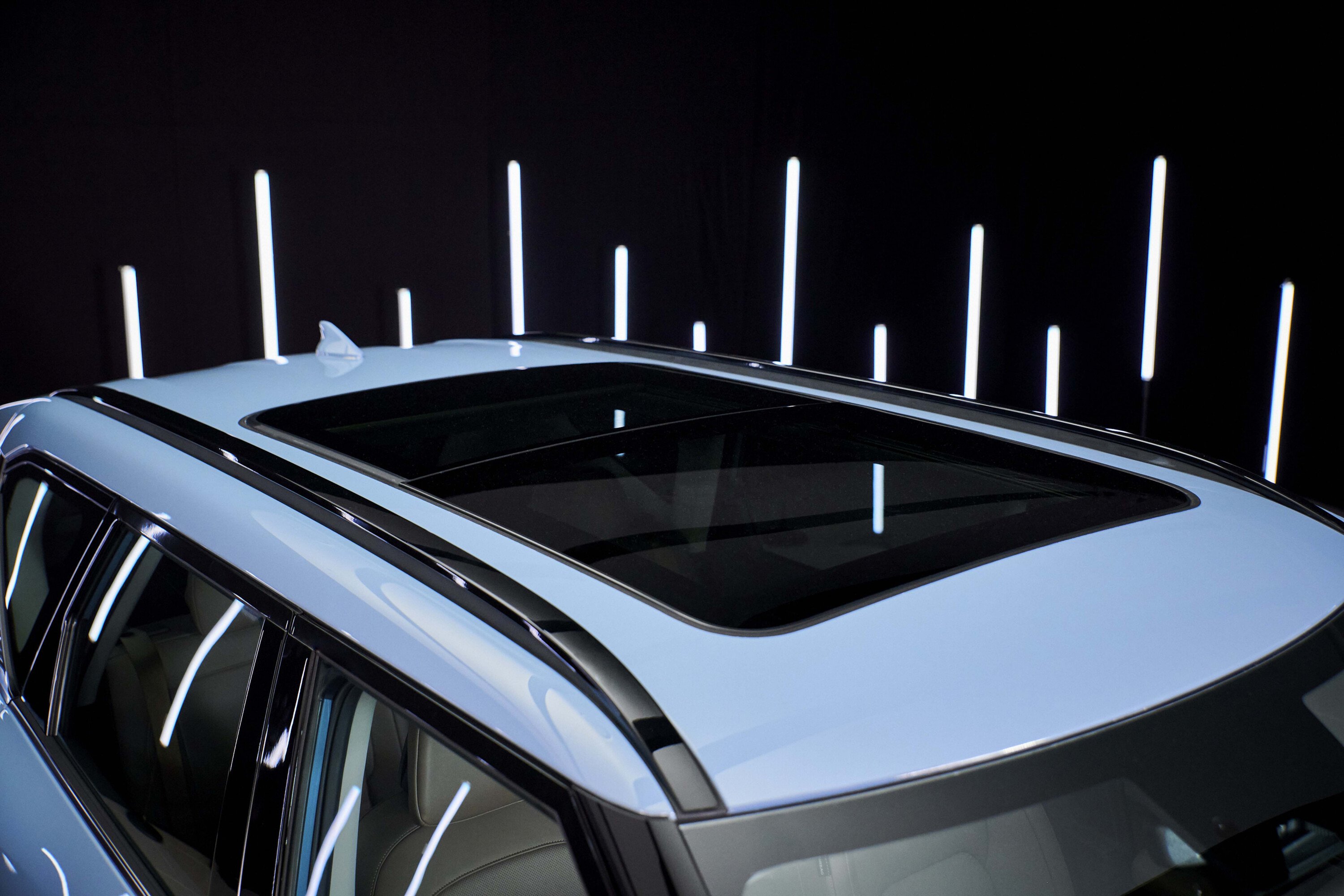

While it’s clearly inspired by the show-stopping style of the seven-seat EV9 electric SUV, the five-seat EV5 mid-sized SUV deftly manages to appear part of the visual family, yet a distinctly unique EV offering from Kia. It’s blockier and stockier, yet in no way inferior to the EV9. It’s simply its own thing, which is great from a differentiation perspective.

Presented here in the global hero colour of Frost Blue, this pre-production EV5 is apparently a mixture of specs – essentially a left-hand-drive EV5 GT-Line with a few Earth-spec elements such as (potentially) the four-blade-spoke 19-inch alloys with 235/55R19 Nexen tyres (given that 2023’s Concept EV5 wore 21s with Pirellis).

https://www.facebook.com/WheelsAustralia/videos/1684332665639858/

Also featured on this pre-production EV5 is Kia’s full digital face with a horizontal light bar linking the rather aggressively angled, C-sectioned LED running lights.

Like the Oz-spec EV9 with its missing light-pattern ‘grille’, the Australian EV5 won’t feature the centre light bar due to ANCAP pedestrian impact requirements.

Beneath the clamshell bonnet is a fully insulated separate luggage area that isn’t huge, but it is neatly trimmed and usefully shaped – much like the overall body design of the EV5. With its blistered wheelarches and dramatically tapered glasshouse, the EV5 is very much a relative of the EV9. But there’s much to like about its more animated front lighting and abruptly cut-off tail.

Inside, the treatment is very similar to EV9, but concentrated.

The EV5 has the same excellent four-spoke SUV steering wheel with drive-mode button at the bottom, as well as a column-mounted transmission selector, twin 12.3-inch screens segmented by a smaller 5.0-inch climate-control screen, and physical centre-dash controls for temperature adjustment and audio volume.

As in EV9, the smooth interior plastics aren’t necessarily soft touch, though there is a degree of squishiness to the dashboard surface. And while the other plastics don’t quite achieve the silky matte finish of the EV9, they’re not too dissimilar.

Our pre-production EV5 featured hero-colour Nougat Brown two-tone upholstery with Nougat Brown seatbelts, and I think it looks quite classy – especially alongside the bronze accents underneath the armrests on each door.

The way the upper dashboard sweeps around and blends into the doors feels more interconnected than in the slabbier EV9 – enhanced by a band of ambient lighting that runs across the top of the doors, then seamlessly bisects the lower Nougat Brown part of the dash from the upper black section just below the cowl.

The cowl itself does feel slightly higher than in an EV9, but maybe that’s because the dash slopes downwards more (rather than being a flat expanse), with a lower hip-point to the seating.

Yet the EV5 does feel like a significantly smaller vehicle than the EV9, despite the clearly visible humps of its outer bonnet haunches (as opposed to the cinemascopic expanse of flat bonnet and glass in the imperious EV9), making the EV5 feel bigger than it actually is.

This car has what the Chinese call a centre bench-type seat, where there’s an extra seat hump in the middle (without a belt) disguising a little phone pocket underneath the upholstery, and then ahead of that is a floating tray with the wireless phone charger and dual cupholders, plus a huge, semi-hidden rubberised tray beneath. You have to reach deep down to grab anything, however, because you can’t lift the centre section up to access it.

Above the centre bench-type seat is just a simple folding armrest that doesn’t open or close, while ahead on the dash in a concealed take-away hook that may prove handy for smaller bags.

And to keep everything uncluttered, Kia has located the front-seat heating and cooling switches near the door handles.

The front seats themselves are really good. In this instance, the driver gets multi-way electric control with an electric ottoman extender, electric seat recline and electric lumbar, whereas the front passenger (at least when the bench-type seat is fitted) only gets four-way electric adjustment, without any cushion tilt.

Thankfully, under-thigh support is impressive – often a failing in Korean cars – and the multi-position headrest is a welcome touch. But the door bottle storage is pitiful – 600ml bottles at best, which lags well behind the EV9 or even the new-gen Hyundai Kona.

In the rear, the roomy EV5 feels expansive and well thought-out. There’s an ingenious picnic table – a very solid single tray on the back of the front passenger’s seat, complete with pen holder and easy access to the USB-C ports on the sides of the front seats.

And because the rear air vents are mounted in the B-pillars (just like EV6), there’s room for a large centre slide-out tray that Kia plans to offer with heating and cooling (for food and drinks), though this wasn’t on our pre-production EV5.

The seat itself is excellent – impressively supportive, with a terrific forward view and supple perforated enviro-upholstery that somehow feels nicer than leather, yet nothing like vinyl.

Even the centre position is reasonable, thanks to a fully flat floor, plenty of space in all directions and relatively supple cushion, though the centre backrest (incorporating the folding armrest) is a bit firm.

While there’s no fore-aft adjustment for the rear bench, the 60/40 backrests can be adjusted in 10 positions, and when they’re folded, the EV5’s cargo floor is completely flat (with in-built flaps to cover the gap between seat and boot floor) for outstanding versatility … tempered only by the pathetic little bottle slots in the rear doors.

At least the EV5’s boot area is tremendous. Kia is yet to quote a volume amount but in person, it’s intelligently shaped and looks highly useful.

There are two floor sections that lift up – both disguising under-floor bins – though the section near the boot edge actually cantilevers up against the rear backrest to make a clever shelf.

The panelling on the cargo area’s side sections house three bins each – making six in total – and there’s a three-prong power outlet, plus moveable cargo knobs that can be used for both shopping bags or tidying up your cabling.

And the finish in the EV5’s boot area is just as consistent as the rest of the vehicle, even in this pre-production model.

If the EV5 drives as well as it looks, it’s hard to see how this medium electric SUV can fail to succeed

Given contemporary Australia’s conservatism when it comes to colour, it’s potentially unlikely that we’ll see the Nougat Brown interior, though the top-spec Thai EV5 (it went on sale there a week ago) does offer that interior colour, as well as a vibrant Marine Navy (think petrol blue) alternative, as well as Frost Blue and Iceberg Green exterior colours.

Either way, if the EV5 drives as well as it looks, and costs as little as Kia Australia promises, it’s hard to see how this Korean-designed, Chinese-built, Australian-tuned medium electric SUV can fail to succeed.

Kia says it should have no issue accessing around 850 units of supply per month. But based on our initial walk-around, 10,000 Australian EV5 sales per year might actually prove to be a little conservative.

Just in case you thought the Polestar 7 would be a massive flagship SUV…

Long, long ago, French carmaker Peugeot would give each successive generation in a series its own number, thus never repeating model names over the years.

Polestar has revealed it will take a similar approach to its model naming – but, where Peugeot’s model lines helped to create a hierarchy by establishing a fixed first number in a three-digit name where only the final number ever changed, Polestar won’t link size or price to its model numbers. Its model naming method will be purely chronological.

This means that while an increasing number of brands use alphanumericals to help buyers understand a model’s dimensions, position and purpose with only the slightest familiarity, a Polestar 12 could be anything from a large SUV to a third-generation successor to the original Polestar 2 – depending on life cycles and whether any other new body styles join the range in the interim.

We’ve known for sometime that a Polestar 7 is in the works, but it wasn’t until this week that the brand revealed it will effectively be the second-generation Polestar 2 – confirmed by CEO Thomas Ingenlath in an interview with the UK’s Autocar.

The 7 may end up being larger than the 2, however, with the 2’s compact interior limiting its appeal and sales potential as a price rival to the more capacious Tesla Model 3. Indeed, Ingenlath sees Polestar’s approach to model naming as a clever way of avoiding the “trap” of market expectations of what a familiar badge should represent in size, design and price.

“As much as we might build a very similar car, because it has a different number we won’t have this natural trap where we’re boxed into that concept of what the car had been,” he said.

“As nice as it is to have a ‘Golf’ category of car, it’s very limiting in terms of innovative power, because you’re always back in the box of what the ‘Golf’ should be.”

Whatever Polestar’s plans, Ingenlath isn’t saying much else. “What type of car and how we will do it, we can discuss when it’s time,” the former Volvo design boss told Autocar.

For now, we can be sure that the Polestar 7 will switch from the 2’s petrol- and diesel-shared CMA platform from Volvo, to a version of the EV-focused SEA platform that underpins the new Polestar 4 – an architecture again developed primarily by Volvo, but for all Geely group members.

The Polestar 7 is expected to enter European production in 2027 – seven years after the 2 rollout began – but it remains to be seen if Australia’s 7 will come from there or from China.

Perhaps the biggest question is whether it will have a rear window – or if, like Peugeot in 2012, Polestar will eventually settle on a number. 8 has a couple of rings to it…

The Polestar range as we know it

The small 2 was followed recently by the Polestar 3 large SUV, which is produced at Volvo’s USA plant in South Carolina and Chengdu, China. The luxury electric car will reach Australia this year.

The Polestar 4 coupe crossover is a slightly more affordable and compact companion to the 3, produced at another separate plant: Geely’s Hangzhou Bay factory in China. It’s positioned squarely to rival the newly revealed Porsche Macan EV.

Finally, the Polestar 5 large grand tourer sedan and related Polestar 6 convertible roadster will be made at the carmaker’s first dedicated factory in Chongqing, China, starting this year. The 6 will follow in 2026, launching with an LA Concept variant limited to 500 examples globally – which have all been sold out.

The Polestar 0 is also planned for release by 2030, as the brand’s first climate-neutral production car from start to finish in the circular economy.