On the face of, the quotes from Toyota’s top man – and the grandson of the company’s founder – read straight from the Terry and Karen playbook of anti-EV disinformation.

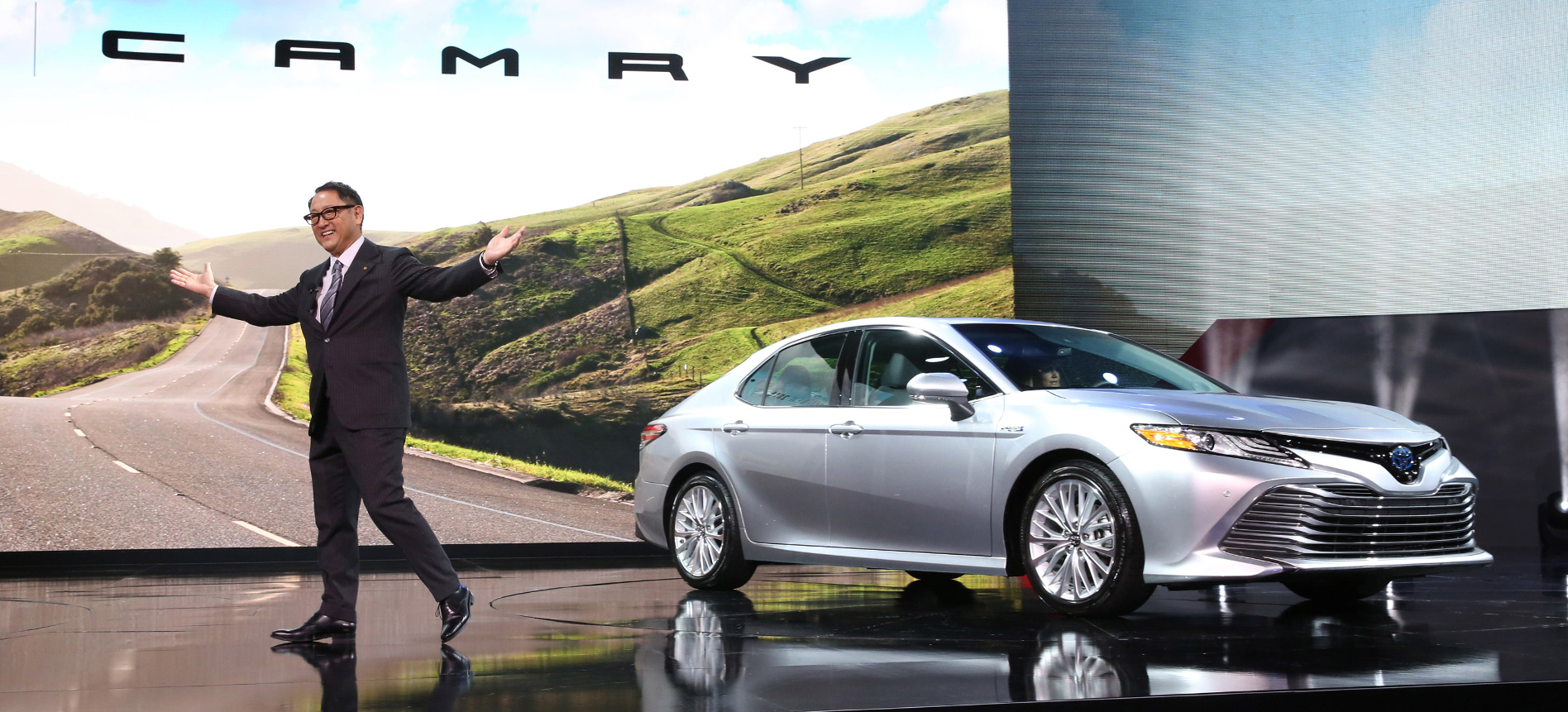

“The more EVs we build, the worse carbon dioxide gets…When politicians are out there saying, ‘Let’s get rid of all cars using gasoline,’ do they understand this?” said Toyota CEO Akio Toyoda in his role as chairman of the Japan Automobile Manufacturers Association at an end-of-year function.

He went on to say that if Japan moves too quickly to ban petrol-powered cars, “the current business model of the car industry is going to collapse,” resulting in the potential loss of millions of jobs in the world’s third-biggest economy.

He suggested, too, that Japan would run out of electricity in summer months if all cars were EVs, that it would cost upwards of A$500 billion to build sufficient EV infrastructure, and that because Japan’s energy is produced with natural gas and coal, the effect on the environment would still be negative.

So what gives?

On the face of it, Toyoda (below) is clearly putting Toyota’s cards on the table with the new Japanese prime minister Yoshihide Suga and his Liberal Democratic party’s recently mooted plans to ban the sale of ICE-only cars in the country.

Underneath, however, it points to a car industry that’s trapped between two fronts; keeping the lights on in the face of declining demand and answering to the increasingly strident calls of governments around the planet to address the issue of climate change.

The state of EV play

While global markets are recovering, sales figures from 2020 will still mark an average decline of car sales across the globe in the order of 10 to 15 per cent.

Even though carmakers are enjoying currently healthy profit margins in the wake of pent-up demand, the bubble will likely pop as the bill for COVID-19 falls due in 2021 and beyond in the form of flattening sales in the wake of economic contraction from governments and employers.

This means less money on hand at a time when EV research and development costs are skyrocketing.

And while governments from Tokyo to London are loudly proclaiming that the car industry needs to adapt to climate change (despite the fact that personal transport’s contribution to greenhouse gas creation is far lower than, say, primary industry, transport or food production), the wider industry isn’t ready to roll out a fleet of affordable cars that can easily replace the ICE cars of today.

Reduce, reprice and recycle

Presently, an EV indeed does produce more greenhouse gases to build when compared to an ICE car – but studies have shown that this is offset within the first 10,000km of driving an EV, thanks to its lack of emissions.

The scales will tip further in the favour of EVs as carmakers are able to scale up production, figure out how to build lower-impact batteries and effectively re-life or recycle those batteries at the end of their working life.

As well, the crossover point where ICE cars and EVs are priced the same is approaching, with a report by Bloomberg New Energy Finance this week suggesting that the price of lithium-ion battery packs per kilowatt/hour will shrink to US$101 by 2023, and to as little as US$58 per hour by 2030.

Currently, they sit at around US$130 per kW/hr, from a high of $1100 just ten years ago.

At US$58 per kW/hr, an EV could be up to 40 per cent cheaper than an ICE car, according to the report.

Toyota’s investment in EV technology over the next decade – some A$20 billion) is at lower levels than some of its competitors.

Mercedes-Benz, for example, has announced it will pour more than A$110b into the space in the next four years, with the Volkswagen Group outlaying a similar amount over a slightly longer timeframe of nine years.

Interestingly, the remarks don’t come long after Toyoda’s pointed swipe at Tesla and its position in the global automotive landscape.

According to the Japanese giant, the Californian EV startup has not only grossly overestimated its value of $400bn (A$550bn), but is not yet adequately mature to be influencing global automotive trends – particularly in the electric technology space.

Toyota’s eggs are, for the moment, all in the hybrid basket, which won’t preclude it from selling cars in markets where bans on ICE cars are looming.

But if the boss of the world’s biggest carmaker isn’t singing the praises of the EV by now, where does it leave the industry as a whole?

Things just got pretty interesting.